Welcome to the world of Real Estate Investment Trusts (REITs) – where real estate meets investment opportunities! Whether you’re a seasoned investor or just dipping your toes into the financial market, understanding and investing in REITs can offer you a unique way to diversify your portfolio and potentially generate passive income. Let’s dive into what REITs are, the different types available, and the benefits they can bring to your investment strategy.

What are REITs?

Real Estate Investment Trusts (REITs) are companies that own, operate, or finance income-generating real estate across a range of sectors. When you invest in a REIT, you’re essentially buying shares in these real estate ventures without having to buy the physical properties yourself.

One key requirement for a company to qualify as a REIT is that it must distribute at least 90% of its taxable income to shareholders in the form of dividends. This characteristic makes REITs an appealing option for investors seeking regular income streams from their investments.

REITs can be publicly traded on major stock exchanges like individual stocks, making them easily accessible for individual investors looking to add real estate exposure to their portfolios. They offer diversification benefits by providing exposure to different types of properties such as residential, commercial, healthcare, and more.

In essence, REITs provide individuals with an opportunity to invest in real estate without the hassle of property management while potentially benefiting from capital appreciation and dividend payouts.

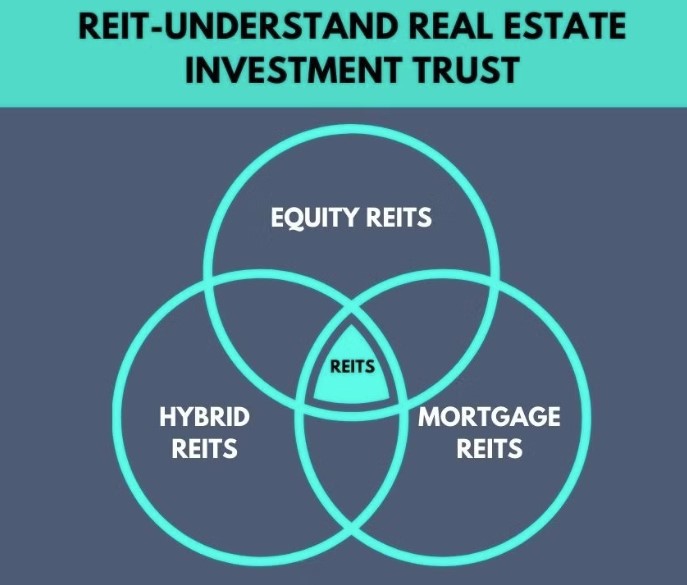

Types of REITs

When it comes to Real Estate Investment Trusts (REITs), there are several types that investors can consider. One common type is equity REITs, which invest in and own properties, generating income through leasing space and collecting rent from tenants. These could include residential, commercial, or industrial properties.

Another type is mortgage REITs, which provide financing for income-producing real estate by purchasing mortgages or mortgage-backed securities. They earn income through the interest on these investments.

Hybrid REITs combine elements of both equity and mortgage REITs in their investment strategies. They may own properties while also providing financing for real estate projects.

There are public non-listed REITS (PNLR) that do not trade on stock exchanges but still offer opportunities for investors seeking diversification in their portfolios with potentially higher yields than traditional investments like stocks or bonds.

Benefits of Investing in REITs

Investing in REITs can be a lucrative way to diversify your portfolio and gain exposure to the real estate market without having to buy physical properties. With their high dividend yields, potential for capital appreciation, and added layer of risk mitigation through diversification, REITs offer an attractive investment opportunity for both seasoned investors and those new to the game.

Whether you are looking for regular income streams or long-term growth potential, adding REITs to your investment strategy could prove to be a smart move. Remember, like any investment, it’s essential to do thorough research and consult with financial advisors before making any decisions. Stay informed, stay diversified, and consider the benefits that investing in REITs can bring to your overall financial goals.