Diving into the world of Student loan consolidation, get ready to discover the ins and outs of managing those pesky student loans. From understanding the basics to exploring the different types, this guide will help you navigate the maze of student loan consolidation with style.

Whether you’re a recent graduate or a seasoned professional looking to streamline your loan payments, this comprehensive overview will arm you with the knowledge needed to make informed decisions about your financial future.

What is Student Loan Consolidation?

Student loan consolidation is the process of combining multiple student loans into a single loan, usually resulting in a lower monthly payment and a longer repayment term. This can make it easier for borrowers to manage their student loan debt.

How Student Loan Consolidation Works

When you consolidate your student loans, a new lender pays off your existing loans and issues you a new loan for the total amount. This new loan typically comes with a fixed interest rate based on the average interest rates of the loans being consolidated. By combining multiple loans into one, borrowers only have to make one monthly payment to a single lender.

Benefits of Student Loan Consolidation

- Lower Monthly Payments: Consolidation can lower your monthly payment by extending the repayment term, making it more manageable.

- Fixed Interest Rate: With a fixed interest rate, you can avoid fluctuations in interest rates, providing stability in your monthly payments.

- Simplified Repayment: Having only one loan and one lender to deal with can simplify the repayment process and reduce the chances of missing payments.

- Potential for Lower Interest Rate: In some cases, borrowers may be able to secure a lower interest rate through consolidation, saving money over time.

Types of Student Loan Consolidation

When it comes to student loan consolidation, there are different options available based on whether you have federal or private loans. Each type has its own set of rules and benefits, so it’s important to understand the differences.

Federal Student Loan Consolidation

Federal student loan consolidation allows you to combine multiple federal loans into one new loan with a fixed interest rate. This can simplify repayment by combining all your loans into one monthly payment. However, keep in mind that federal consolidation may not lower your interest rate.

Private Student Loan Consolidation

Private student loan consolidation involves refinancing your existing private student loans into a new private loan with a new interest rate, repayment term, and monthly payment. Private consolidation can sometimes offer lower interest rates, but it may not come with the same borrower protections as federal consolidation.

Comparing Federal and Private Consolidation

– Federal consolidation is only available for federal loans, while private consolidation is for private loans.

– Federal consolidation offers income-driven repayment plans and loan forgiveness options, which private consolidation does not typically provide.

– Private consolidation may result in a lower interest rate, but it may not offer the same benefits as federal consolidation.

Eligibility Criteria

To be eligible for federal student loan consolidation, you must have federal loans that are in grace, repayment, deferment, or default status. Private student loan consolidation eligibility varies by lender but typically requires a good credit score and stable income.

How to Apply for Student Loan Consolidation

When it comes to applying for student loan consolidation, there are a few key steps you need to follow to navigate the process successfully. Make sure you have all the required documents in order and prepare a strong application to increase your chances of approval.

Required Documents for Application Process

- Proof of identity (such as driver’s license or passport)

- Social Security Number

- Details of your current loans

- Income verification (pay stubs or tax returns)

- List of monthly expenses

Tips for a Successful Application

- Organize your documents beforehand to streamline the application process.

- Double-check all information provided for accuracy and completeness.

- Make sure you meet all eligibility requirements before applying.

- Consider enlisting the help of a financial advisor or counselor for guidance.

- Submit your application as soon as possible to avoid delays in processing.

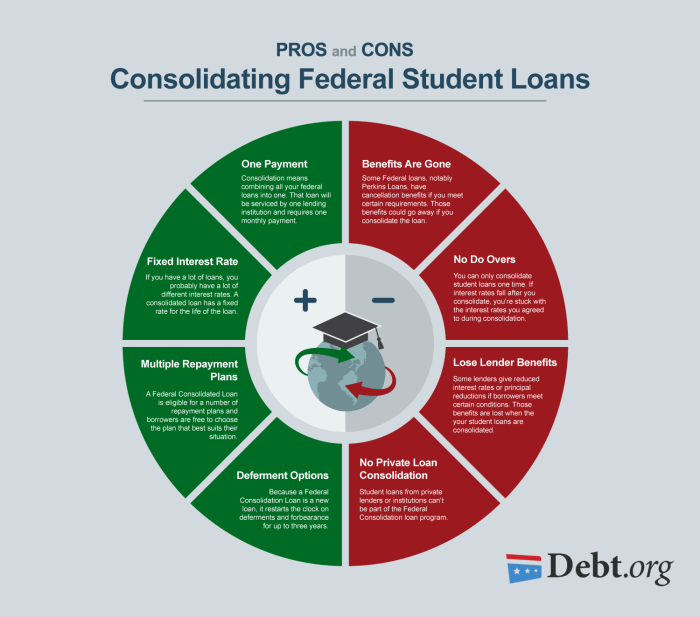

Pros and Cons of Student Loan Consolidation

When considering student loan consolidation, it’s essential to weigh the advantages and disadvantages to make an informed decision about your financial future.

Advantages of Student Loan Consolidation:

- Lower Monthly Payments: Consolidating multiple loans into one can result in a single, lower monthly payment, making it easier to manage your finances.

- Fixed Interest Rate: By consolidating, you may be able to lock in a fixed interest rate, protecting you from potential rate increases in the future.

- Simplified Repayment: Managing one loan instead of multiple can streamline the repayment process and reduce the chances of missing payments.

- Potential for Lower Interest Rates: Depending on the loans being consolidated, you may qualify for a lower overall interest rate, saving you money in the long run.

Drawbacks of Student Loan Consolidation:

- Extended Repayment Period: While lower monthly payments can be beneficial, extending the repayment period through consolidation may result in paying more in interest over time.

- Loss of Benefits: Some federal loans offer benefits such as loan forgiveness or income-driven repayment plans, which may be forfeited when consolidating.

- Potential for Higher Total Costs: Consolidating loans with varying interest rates can result in a higher overall interest rate, increasing the total cost of the loan.

- Limited Options for Private Loans: Private loan consolidation may not offer the same benefits or protections as federal loan consolidation, leaving borrowers with fewer options.

Factors to Consider Before Opting for Student Loan Consolidation:

- Loan Types: Consider the types of loans you have, whether federal or private, and how consolidation may impact their terms and benefits.

- Interest Rates: Compare the interest rates of your current loans with the rates offered through consolidation to ensure you’re getting the best deal.

- Financial Goals: Evaluate your long-term financial goals and how consolidation fits into your overall repayment strategy.

- Repayment Terms: Determine if the repayment terms of the consolidated loan align with your budget and financial situation.