Get ready to dive into the world of real estate investment strategies, where the game is all about making smart moves and securing those profits. From short-term quick wins to long-term investments, this topic is your ultimate guide to mastering the art of real estate investments. So grab your shades and let’s roll!

Real estate investment strategies are like the secret sauce to building wealth in the property market. Whether you’re a seasoned investor or a newbie looking to make your mark, understanding these strategies is key to unlocking lucrative opportunities in the real estate world.

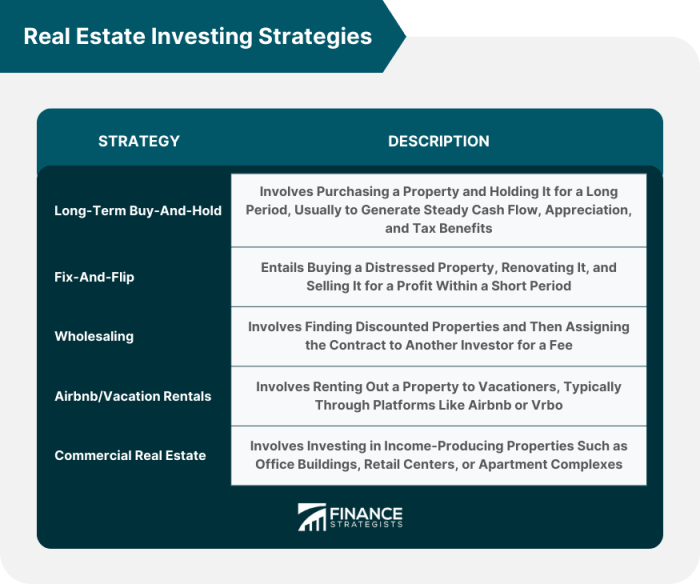

Real Estate Investment Strategies

Real estate investment strategies refer to the various approaches and plans that investors use to make money from real estate properties. These strategies help investors maximize their returns and minimize risks in the real estate market.

Types of Real Estate Investment Strategies

There are several types of real estate investment strategies that investors can choose from:

- Fix and Flip: Buying properties below market value, renovating them, and selling for a profit.

- Rental Properties: Buying properties to rent out to tenants and generate rental income.

- Wholesaling: Contracting properties at a low price and selling the contract to another buyer at a higher price.

- Real Estate Investment Trusts (REITs): Investing in publicly traded companies that own income-producing real estate.

The Importance of a Well-Defined Investment Strategy

Having a well-defined investment strategy in real estate is crucial for success. It helps investors make informed decisions, stay focused on their goals, and adapt to market changes effectively.

Short-Term vs. Long-Term Investment Strategies

Short-term real estate investment strategies focus on quick returns through activities like fix and flip, while long-term strategies involve holding onto properties for an extended period to benefit from appreciation and rental income.

Property Types for Investment

Investing in real estate offers a variety of property types to consider, each with its own set of advantages and disadvantages. Understanding the different options available can help investors make informed decisions to maximize their returns.

Residential Real Estate

Residential real estate includes properties such as single-family homes, condominiums, townhouses, and multi-family units. Investing in residential properties can provide stable rental income, potential for property appreciation, and tax benefits. However, challenges may include property management, tenant turnover, and economic downturns affecting rental demand.

Commercial Real Estate

Commercial real estate comprises properties used for business purposes, such as office buildings, retail spaces, and industrial warehouses. Investing in commercial real estate offers higher income potential, longer lease terms, and lower tenant turnover compared to residential properties. However, risks involve longer vacancy periods, higher operating costs, and market fluctuations impacting rental rates.

Alternative Property Types

Apart from residential and commercial properties, investors can explore alternative options like industrial properties, mixed-use developments, or specialty real estate such as healthcare facilities, self-storage units, or hospitality properties. These property types offer unique investment opportunities based on specific market demands and trends, diversifying investment portfolios and potentially yielding higher returns.

Financing Options

When it comes to real estate investments, understanding the different financing options available is crucial for success. From traditional bank loans to private financing, each option has its own unique advantages and considerations to keep in mind.

Traditional Bank Loans vs. Private Financing

- Traditional Bank Loans:

- Offer competitive interest rates and terms.

- Require a good credit score and financial history.

- May have stricter approval processes and longer wait times.

- Private Financing:

- Can be more flexible in terms of approval criteria.

- May have higher interest rates but quicker approval processes.

- Can be ideal for investors with unique financial situations.

Leveraging in Real Estate Investment

Leveraging in real estate investment refers to using borrowed funds to increase the potential return on investment. By putting down a smaller amount of your own money and using financing, you can control a larger asset and potentially increase your profits.

Evaluating the Best Financing Option

- Consider your financial situation and credit score.

- Assess the terms and interest rates of each financing option.

- Think about the timeline and urgency of your investment.

- Consult with a financial advisor or real estate expert for personalized guidance.

Risk Management

Real estate investment comes with its fair share of risks that investors need to be aware of. By understanding these risks and implementing effective strategies, investors can mitigate potential losses and maximize returns.

Common Risks in Real Estate Investment

- Market Risk: Fluctuations in property values due to economic conditions or changes in supply and demand.

- Liquidity Risk: Difficulty in selling a property quickly without significant loss.

- Interest Rate Risk: Changes in interest rates affecting financing costs and property values.

- Operational Risk: Unexpected expenses, vacancies, or damages impacting cash flow.

- Regulatory Risk: Changes in laws or regulations affecting property use or ownership.

Strategies to Mitigate Risks

- Conduct thorough market research before investing to understand trends and potential risks.

- Diversify your real estate portfolio across different property types and locations to spread risk.

- Maintain adequate insurance coverage to protect against unforeseen events like natural disasters or liability claims.

- Establish emergency funds for unexpected expenses or periods of low cash flow.

Diversifying Real Estate Investment Portfolios

- Invest in a mix of residential, commercial, and industrial properties to reduce exposure to specific market sectors.

- Consider investing in real estate investment trusts (REITs) or real estate crowdfunding platforms for diversification.

- Explore international real estate markets to access different economic conditions and opportunities.

Impact of Market Conditions on Risk Management

- In a booming market, there may be increased competition and inflated property prices, leading to higher investment risks.

- In a recession, property values may decline, impacting cash flow and liquidity for investors.

- Interest rate hikes can increase financing costs, affecting profitability and investment returns.

- Changes in regulations or zoning laws can impact property values and rental income, increasing regulatory risks.