Diving into the world of investment portfolio management, this guide will take you on a journey through the ins and outs of strategically managing your investments. Get ready to level up your financial game with this comprehensive look at maximizing returns and minimizing risks.

From understanding the basics to implementing advanced strategies, this guide has got you covered.

Introduction to Investment Portfolio Management

Investment portfolio management refers to the process of overseeing an individual’s or institution’s investment assets to achieve specific financial goals. This involves making decisions on what securities to buy, hold, and sell within the portfolio.

Importance of Managing an Investment Portfolio

Effective investment portfolio management is crucial for maximizing returns while minimizing risks. By diversifying investments across different asset classes, sectors, and regions, investors can reduce the impact of market volatility and potentially enhance long-term performance.

- Ensures alignment with financial goals

- Helps in managing risk

- Optimizes returns

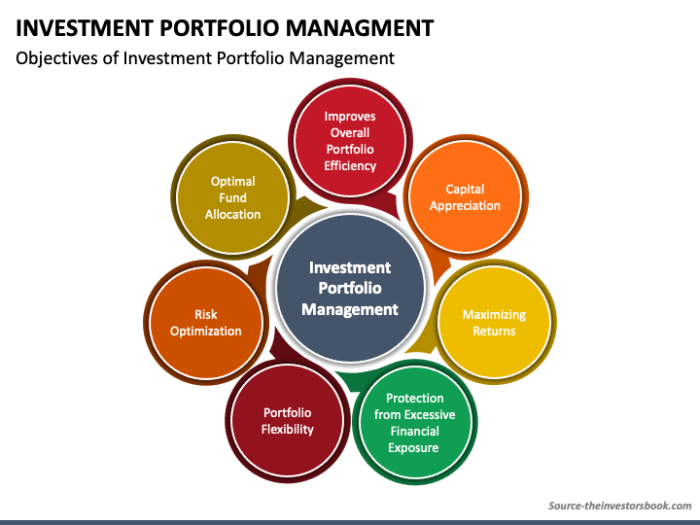

Primary Objectives of Investment Portfolio Management

The primary objectives of investment portfolio management include maximizing returns, managing risk, and maintaining liquidity to meet financial obligations when needed.

- Maximizing Returns: Striving to achieve the highest possible returns within the risk tolerance of the investor.

- Managing Risk: Balancing risk and return by diversifying the portfolio to reduce exposure to any single asset or market.

- Maintaining Liquidity: Ensuring that there are sufficient liquid assets to meet short-term financial needs or emergencies.

Types of Investment Portfolios

There are various types of investment portfolios based on factors such as risk tolerance, investment horizon, and financial goals. Some common types include:

Individual Stock Portfolio: Consists of individual stocks purchased directly by the investor.

Mutual Fund Portfolio: Comprised of a collection of stocks, bonds, or other securities managed by a professional fund manager.

Retirement Portfolio: Designed to provide income during retirement years and may include a mix of stocks, bonds, and other assets.

Building an Investment Portfolio

Investing in the financial markets involves building a well-diversified investment portfolio to achieve your financial goals. This process requires careful consideration of various factors to ensure a balance between risk and return.

Factors to Consider when Selecting Investments

When selecting investments for your portfolio, it is essential to consider factors such as your investment goals, risk tolerance, time horizon, and investment knowledge. Diversification is also crucial to spread risk across different asset classes.

- Asset Allocation: Determine the percentage of your portfolio allocated to different asset classes such as stocks, bonds, real estate, and commodities.

- Risk Tolerance: Assess your comfort level with risk and choose investments that align with your risk tolerance.

- Liquidity: Consider how easily you can buy or sell an investment, as this can impact your ability to react to market changes.

- Costs and Fees: Evaluate the costs associated with each investment, including management fees, trading costs, and taxes.

Comparing Asset Classes for Portfolio Diversification

Diversifying your portfolio across different asset classes can help reduce risk and enhance returns. Each asset class has its own characteristics, benefits, and risks that contribute to overall portfolio performance.

| Asset Class | Characteristics | Risk Level |

|---|---|---|

| Stocks | Potential for high returns, but volatile | High |

| Bonds | Provide income and stability, lower returns than stocks | Low to Moderate |

| Real Estate | Offers diversification, income, and potential for appreciation | Moderate |

| Commodities | Can hedge against inflation, but volatile | High |

Balancing Risk and Return Strategies

Balancing risk and return in a portfolio involves implementing strategies that align with your financial objectives and risk tolerance. Consider the following approaches to achieve a well-balanced portfolio:

- Asset Allocation: Distribute your investments across different asset classes to manage risk and optimize returns.

- Rebalancing: Regularly review and adjust your portfolio to maintain the desired asset allocation and risk level.

- Dollar-Cost Averaging: Invest a fixed amount regularly to reduce the impact of market volatility on your portfolio.

- Asset Allocation Funds: Consider investing in mutual funds or exchange-traded funds (ETFs) that offer diversified exposure to multiple asset classes.

Monitoring and Rebalancing

Monitoring and rebalancing an investment portfolio are crucial aspects of portfolio management to ensure that the portfolio remains aligned with the investor’s financial goals and risk tolerance. By regularly monitoring the performance of the portfolio and making necessary adjustments through rebalancing, investors can optimize their returns and manage risks effectively.

Importance of Monitoring

Regular monitoring of an investment portfolio allows investors to track the performance of their assets, identify any underperforming investments, and make informed decisions based on market conditions. It helps investors stay on top of any changes in their portfolio’s value and make timely adjustments to maintain their desired asset allocation.

Key Metrics for Evaluation

- Annualized Return: Calculated by measuring the average annual return of the portfolio over a specific period.

- Sharpe Ratio: Indicates the risk-adjusted return of the portfolio, helping investors assess the efficiency of their investments.

- Portfolio Beta: Measures the portfolio’s sensitivity to market movements, indicating how volatile the portfolio is compared to the market.

Triggers for Rebalancing

- Asset Allocation Drift: When the actual allocation deviates significantly from the target allocation, it may be time to rebalance.

- Market Changes: Significant market movements or changes in economic conditions may necessitate rebalancing to realign the portfolio.

- Life Events: Changes in the investor’s financial goals, risk tolerance, or time horizon may require adjustments to the portfolio through rebalancing.

Tools and Techniques for Portfolio Monitoring

- Portfolio Management Software: Utilize specialized software that provides real-time tracking of investments, performance analysis, and risk assessment.

- Performance Reports: Regularly review performance reports to assess the progress of the portfolio against benchmarks and goals.

- Stop-Loss Orders: Implement stop-loss orders to automatically sell an asset if it reaches a predetermined price, helping manage downside risk.

Risk Management in Investment Portfolio

Investing in the financial markets always involves a certain level of risk. Risk management in investment portfolios is the process of identifying, assessing, and controlling potential risks to protect the portfolio from significant losses.

Types of Risks

- Market Risk: This type of risk arises from the fluctuations in the market prices of securities. Factors such as economic conditions, interest rates, and geopolitical events can impact the value of investments.

- Credit Risk: Credit risk refers to the possibility of a borrower failing to repay a loan or debt obligation. In the context of investment portfolios, it relates to the risk of a bond issuer defaulting on payments.

- Liquidity Risk: Liquidity risk is the risk of not being able to buy or sell an investment quickly enough at a fair price. It can arise when there is low trading volume or when market conditions are unfavorable.

- Reinvestment Risk: Reinvestment risk is the risk that future cash flows from an investment will have to be reinvested at a lower rate of return. This can impact the overall return of the portfolio.

Strategies for Mitigating Risks

- Diversification: By spreading investments across different asset classes, sectors, and geographical regions, investors can reduce the impact of a single investment underperforming.

- Asset Allocation: Allocating funds strategically among different asset classes based on risk tolerance and investment goals can help manage risk exposure.

- Stop-Loss Orders: Setting stop-loss orders to automatically sell a security if it reaches a certain price can limit potential losses in a declining market.

Risk Management Techniques

- Value at Risk (VaR): VaR is a statistical measure used to quantify the level of financial risk within a portfolio over a specific time frame. It helps investors understand the potential losses they could face under adverse market conditions.

- Hedging: Utilizing hedging strategies such as options, futures, and derivatives can help protect a portfolio from adverse market movements by offsetting potential losses.

- Stress Testing: Stress testing involves analyzing how a portfolio would perform under extreme market conditions to identify vulnerabilities and make necessary adjustments.