Diving deep into the world of investment diversification, this intro sets the stage for an exciting journey through the ins and outs of smart investing. With a mix of facts and flair, get ready to explore the keys to building a robust investment portfolio.

In the following paragraphs, we’ll unravel the importance, types, strategies, and tools of investment diversification, shedding light on how to make your money work smarter for you.

Importance of Investment Diversification

Diversification is a key strategy in investing that involves spreading your investments across different asset classes to reduce risk and optimize returns. By diversifying your portfolio, you can protect yourself from the impact of a single investment performing poorly.

Benefits of Diversifying Investments

- Diversification helps to minimize the impact of market volatility on your overall portfolio.

- It allows you to potentially earn higher returns by investing in a variety of assets that perform differently under various market conditions.

- Reduces the risk of losing all your investments in case one asset class underperforms.

How Diversification Helps Manage Risk in Investing

- Spreading your investments across different asset classes, such as stocks, bonds, real estate, and commodities, can help reduce the overall risk in your portfolio.

- When one asset class is experiencing a downturn, others may be performing well, balancing out your overall returns.

- By diversifying, you can protect your investments from specific risks associated with a single company, industry, or market sector.

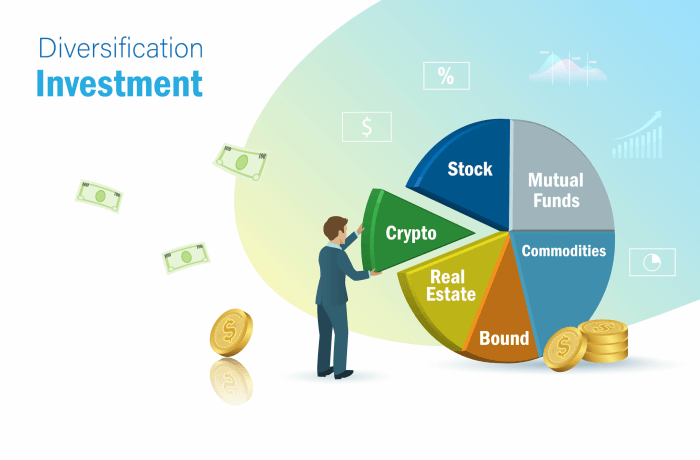

Types of Investment Diversification

When it comes to investment diversification, there are various strategies that investors can employ to spread their risk across different assets. Diversification helps mitigate the impact of market fluctuations on a single investment and can lead to a more stable portfolio overall.

Asset Classes for Diversification

- Stocks: Investing in a mix of large-cap, mid-cap, and small-cap stocks can provide exposure to different segments of the market.

- Bonds: Including government, corporate, and municipal bonds in your portfolio can help balance risk and return.

- Real Estate: Investing in real estate properties or Real Estate Investment Trusts (REITs) can add diversification and potential income.

- Commodities: Adding commodities like gold, silver, or oil can provide a hedge against inflation and economic downturns.

Geographical Diversification

Geographical diversification involves investing in assets across different regions and countries to reduce the impact of local economic conditions on your portfolio. For example, an investor based in the United States may choose to invest in international markets like Europe, Asia, or emerging markets to spread their risk globally.

Diversifying Across Industries or Sectors

Diversifying across industries or sectors means investing in companies from different sectors of the economy, such as technology, healthcare, finance, and consumer goods. This strategy helps reduce the risk of sector-specific downturns affecting your entire portfolio. For example, if the technology sector experiences a downturn, investments in other sectors like healthcare or utilities may help offset potential losses.

Strategies for Investment Diversification

Diversifying your investment portfolio is crucial to reduce risk and maximize returns. Here are some key strategies to effectively diversify your investments:

The 60/40 Rule in Diversification

The 60/40 rule is a common strategy where an investor allocates 60% of their portfolio to stocks and 40% to bonds. Stocks offer higher potential returns but come with higher risk, while bonds provide stability and income. This balanced approach helps manage risk while seeking growth.

Importance of Rebalancing a Diversified Portfolio

Rebalancing involves adjusting the allocation of assets in your portfolio to maintain the desired level of diversification. Over time, market fluctuations can cause your portfolio to deviate from its original allocation. By rebalancing, you can ensure that your risk exposure remains in line with your investment goals.

Using Dollar-Cost Averaging for Diversification

Dollar-cost averaging is a strategy where you invest a fixed amount of money at regular intervals, regardless of market conditions. This approach helps reduce the impact of market volatility on your investments. By consistently buying assets over time, you can diversify your holdings and potentially lower your average cost per share.

Tools and Resources for Implementing Diversification

Investing in a diverse range of assets is crucial for minimizing risk and maximizing returns. There are several tools and resources available to help investors implement diversification effectively.

Online Platforms and Software

- Robo-advisors: These automated platforms create diversified portfolios based on your risk tolerance and investment goals.

- Investment apps: Apps like Robinhood or Acorns provide access to a variety of investment options, making it easy to diversify your portfolio.

- Portfolio management tools: Platforms like Personal Capital or Mint help track your investments and ensure you maintain a diversified portfolio.

Using Mutual Funds or ETFs

- Mutual Funds: These pooled investments allow you to invest in a variety of assets with a single purchase, providing instant diversification.

- ETFs (Exchange-Traded Funds): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks, offering diversification at a lower cost.

- Target-date funds: These funds automatically adjust the asset allocation based on your target retirement date, providing a hands-off approach to diversification.

Role of Financial Advisors

- Financial advisors play a crucial role in helping investors create and maintain a diversified investment portfolio.

- They provide personalized advice based on your financial goals, risk tolerance, and time horizon.

- Financial advisors can recommend specific investments or strategies to ensure your portfolio is well-diversified and aligned with your objectives.