Buckle up your seatbelts, folks! We’re about to dive deep into the world of index funds. Get ready for a rollercoaster ride of financial knowledge and insight that will leave you feeling like a Wall Street pro.

Index funds are like the unsung heroes of the stock market, quietly working behind the scenes to help investors build wealth and secure their financial futures.

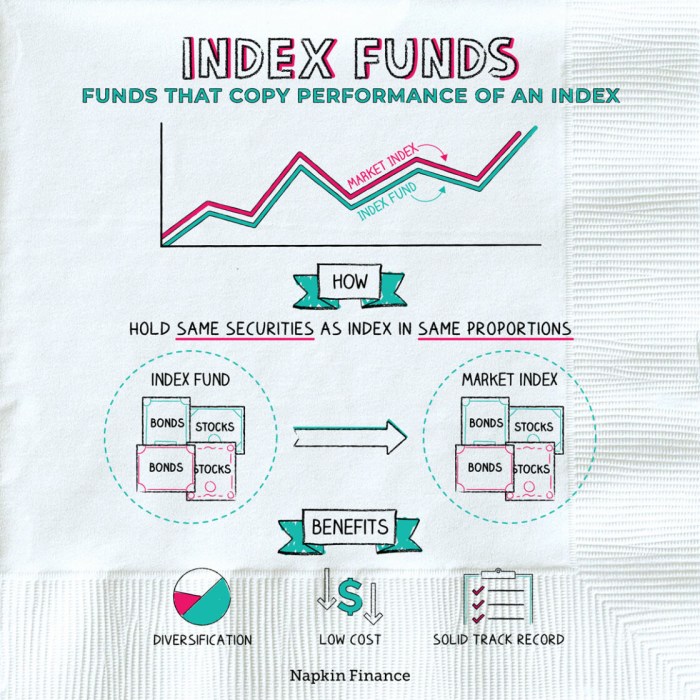

Introduction to Index Funds

Index funds are investment funds that track a specific market index, such as the S&P 500. These funds aim to replicate the performance of the index they are tracking, rather than trying to outperform the market.

Passive investing is the strategy of investing in index funds or other similar vehicles that aim to match the performance of a specific market index. This approach typically involves lower fees compared to actively managed funds, as there is less need for constant buying and selling of securities.

Role of Index Funds in the Stock Market

- Index funds provide investors with exposure to a diversified portfolio of stocks that make up a particular index, reducing the risk associated with individual stock selection.

- They offer a low-cost way for investors to gain broad market exposure without the need for picking individual stocks, making them ideal for long-term investors.

- Index funds are often used as a benchmark to evaluate the performance of actively managed funds, as they provide a baseline for comparison.

How Index Funds Work

Index funds are constructed to mirror a specific market index, such as the S&P 500. This means that the fund holds the same stocks in the same proportions as the index it is tracking. The goal is to match the performance of the index rather than trying to beat it.

Constructing an Index Fund

Index funds are passively managed, meaning they aim to replicate the performance of the chosen index rather than actively trading stocks. This results in lower fees for investors compared to actively managed funds. The fund manager will buy and hold the stocks in the index without frequent buying and selling.

Tracking an Index

To track an index, the fund manager will adjust the holdings periodically to match any changes in the index composition. For example, if a stock is removed from the index, the fund will sell that stock and buy the new stock that has been added. This ensures that the fund’s performance closely mirrors that of the index.

Benefits of Diversification in Index Funds

Index funds provide investors with instant diversification by holding a large number of stocks within a single fund. This helps reduce risk as losses in one company can be offset by gains in others. Diversification is key to managing risk and achieving long-term growth in an investment portfolio.

Advantages of Investing in Index Funds

Investing in index funds comes with several advantages that make them an attractive option for many investors looking to build wealth over time.

Low Fees Associated with Index Funds

Index funds are known for their low fees compared to actively managed funds. Since they are passively managed and aim to replicate a specific index, the operating costs are lower, resulting in higher returns for investors. This cost efficiency is a major advantage for those looking to maximize their investment returns.

Potential for Steady Returns Over the Long Term

One of the key advantages of investing in index funds is the potential for steady returns over the long term. By tracking a specific index, investors can benefit from the overall growth of the market without the need to constantly buy and sell securities. This long-term approach can help investors ride out market fluctuations and achieve consistent returns over time.

Broad Market Exposure

Index funds offer investors broad market exposure by tracking a specific index, such as the S&P 500 or the Dow Jones Industrial Average. This diversification helps reduce risk by spreading investments across a wide range of companies and industries. It also allows investors to participate in the overall growth of the market without having to pick individual stocks, making it a convenient and efficient way to invest in the stock market.

Differences Between Index Funds and Actively Managed Funds

When comparing index funds and actively managed funds, it’s essential to understand the key differences in their strategies, impact of fees on investment returns, and performance.

Strategies of Index Funds and Actively Managed Funds

Index funds aim to replicate the performance of a specific market index by holding the same securities in the same proportion as the index. On the other hand, actively managed funds involve professional portfolio managers actively selecting investments in an attempt to outperform the market.

Impact of Fees on Investment Returns

Index funds typically have lower management fees and operating expenses compared to actively managed funds. These lower fees can significantly impact investment returns over the long term, as higher fees erode returns and reduce the overall performance of actively managed funds.

Performance of Index Funds versus Actively Managed Funds

Studies have shown that over the long term, index funds tend to outperform actively managed funds, primarily due to their lower fees and the challenges of consistently beating the market. While actively managed funds may occasionally outperform the market, the majority of them fail to do so consistently over time.