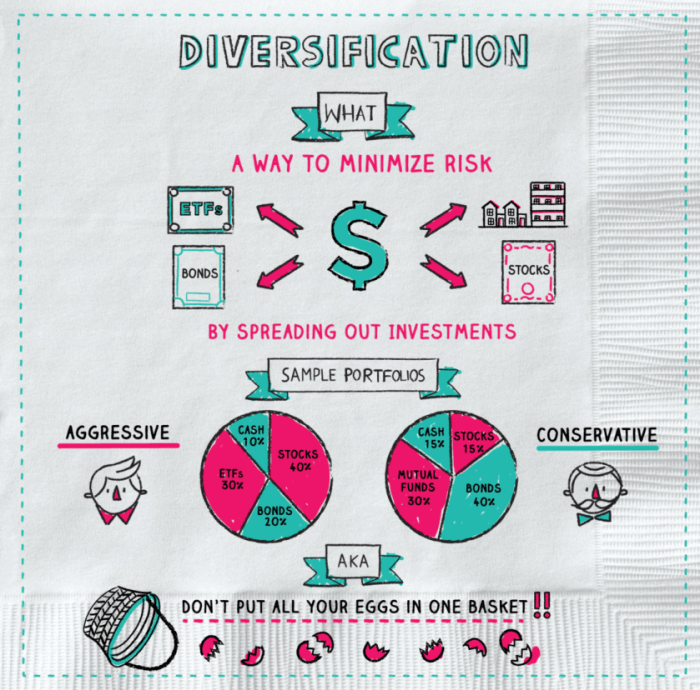

Diving into the world of investments, understanding the importance of diversification is key to success. By spreading your investments across different assets, regions, and sectors, you can reduce risks and maximize returns. Let’s take a closer look at why diversification plays a crucial role in any investment strategy.

Why Diversification is Important

Investing in one thing might seem cool, but diversification is the real deal. It’s like having a squad of investments that got your back and help you stay strong in the financial game.

Reducing Risk

When you spread your investments across different assets like stocks, bonds, and real estate, you’re not putting all your eggs in one basket. This way, if one investment takes a hit, the others can hold you down and minimize the impact on your overall wealth.

Enhancing Returns

Diversification isn’t just about playing it safe; it’s also about boosting your gains. By investing in different sectors or industries, you increase your chances of hitting it big when one of your investments skyrockets. It’s like having multiple lottery tickets instead of just one – more chances to win big!

Types of Diversification

Diversification is essential for reducing risk and maximizing returns. There are various types of diversification strategies that investors can utilize to achieve a well-balanced portfolio.

Asset Class Diversification

Asset class diversification involves investing in different categories of assets such as stocks, bonds, real estate, and commodities. By spreading investments across various asset classes, investors can minimize the impact of downturns in any single asset class and improve overall portfolio performance.

- Diversifying across asset classes helps to mitigate risks associated with market volatility.

- Investors can benefit from the potential growth of different asset classes over time.

- Asset class diversification can enhance portfolio stability and reduce the likelihood of significant losses.

Geographic Diversification

Geographic diversification involves investing in assets located in different regions or countries around the world. This strategy helps to reduce the impact of economic, political, or regulatory risks that may be specific to a particular region.

- By diversifying geographically, investors can benefit from global economic growth opportunities.

- Geographic diversification can protect against localized risks such as currency fluctuations or geopolitical events.

- Investing in different markets can provide exposure to a wide range of industries and sectors, enhancing overall portfolio resilience.

Implementing Diversification

Investing in a diverse range of assets can help manage risk and optimize returns. Here are some steps to effectively implement diversification in an investment portfolio:

Strategies for Diversifying Within Asset Classes

- Allocate investments across different sectors or industries to reduce exposure to specific risks.

- Diversify within asset classes by investing in a mix of stocks, bonds, real estate, and other financial instruments.

- Consider investing in both domestic and international markets to spread geographical risk.

- Utilize different investment strategies, such as value investing, growth investing, or dividend investing, to diversify within asset classes.

The Role of Rebalancing in Maintaining Diversification

Rebalancing is crucial to ensure that your portfolio maintains its desired asset allocation and risk level over time. Here’s why it’s important:

- Regularly review your portfolio and adjust asset allocations to bring them back in line with your investment goals.

- Rebalancing helps to sell high-performing assets and buy underperforming assets, which can help maximize returns in the long run.

- By rebalancing, you can avoid becoming too heavily weighted in one asset class, which could expose you to higher levels of risk.

Risks of Lack of Diversification

When it comes to investing, putting all your eggs in one basket can be a risky move. The lack of diversification in an investment portfolio can expose you to various risks that could potentially lead to significant losses.

Concentration Risk and its Impact

Concentration risk is a major concern when there is a lack of diversification in an investment portfolio. This risk arises when a large portion of the portfolio is invested in a single asset or a small group of assets. If that particular asset or group of assets experiences a decline in value, the entire portfolio is at risk of suffering substantial losses.

- For example, if an investor puts all their money into a single stock and that stock plummets due to poor performance or external factors, the entire investment could be wiped out.

- Similarly, investing only in one industry or sector can leave the portfolio vulnerable to sector-specific risks such as regulatory changes, economic downturns, or shifts in consumer preferences.

Consequences of Not Diversifying Investments

The consequences of not diversifying investments can be severe and long-lasting. Without spreading your investments across different asset classes, industries, or geographic regions, you are essentially putting all your financial well-being at the mercy of a single entity or market condition.

Remember, the old saying “Don’t put all your eggs in one basket” holds true when it comes to investing.

- Investors who fail to diversify may miss out on potential opportunities for growth and income that could have been gained through a more balanced portfolio.

- In times of market volatility, a lack of diversification can amplify losses and make it difficult to recover from setbacks, leading to financial distress and setbacks in achieving long-term financial goals.