When it comes to financial health, understanding your net worth is key. Let’s dive into the world of calculating net worth, exploring the ins and outs of assets, liabilities, and everything in between. Get ready to take control of your financial future!

Understanding Net Worth

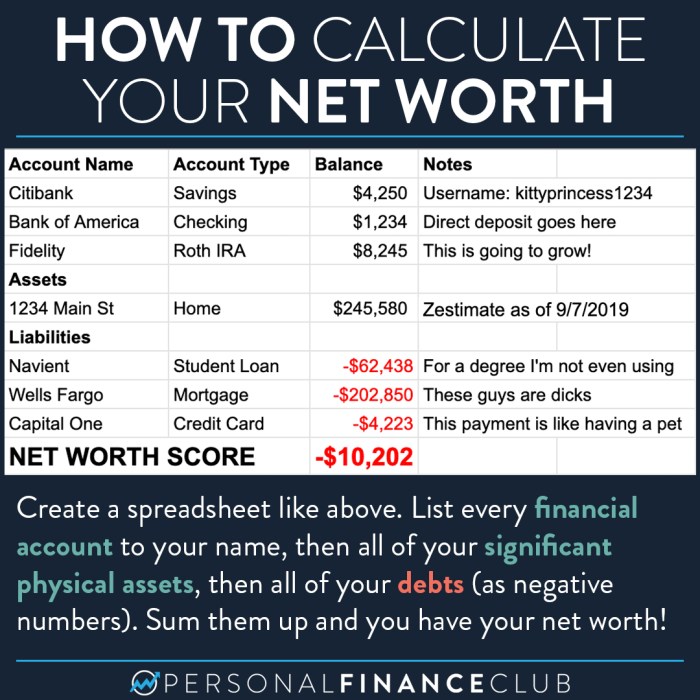

Net worth is the total value of all your assets minus your liabilities. In simpler terms, it is what you own minus what you owe.

Knowing your net worth is crucial because it gives you a clear picture of your financial health. It helps you understand where you stand financially and track your progress towards your financial goals.

Assets and Liabilities

Assets are things of value that you own. This can include cash, investments, real estate, vehicles, and valuable possessions like jewelry or artwork.

Liabilities, on the other hand, are what you owe. This can include mortgages, car loans, credit card debt, student loans, and any other outstanding bills or payments.

By subtracting your total liabilities from your total assets, you can calculate your net worth. A positive net worth means your assets exceed your liabilities, while a negative net worth indicates the opposite.

Calculating Net Worth

Determining your net worth involves subtracting your total liabilities from your total assets. This gives you a clear picture of your financial health and overall wealth.

Formula for Calculating Net Worth

- List all your assets, including cash, investments, real estate, vehicles, and personal belongings.

- Calculate the total value of your assets.

- List all your liabilities, such as mortgages, loans, credit card debt, and other financial obligations.

- Calculate the total value of your liabilities.

- Subtract the total liabilities from the total assets to get your net worth.

Determining the Value of Assets

- For cash and investments, use the current market value.

- For real estate, you can use the appraised value or recent sale prices of similar properties in your area.

- For vehicles, you can check the Kelley Blue Book value or similar resources.

- For personal belongings, estimate their value based on their condition and market demand.

Calculating Liabilities

- Gather all your financial statements and bills to determine the outstanding balances on your mortgages, loans, and credit cards.

- Include any other debts or financial obligations you may have, such as student loans or medical bills.

- Make sure to account for any accrued interest or fees when calculating the total value of your liabilities.

Identifying Assets

When calculating your net worth, it’s crucial to identify all your assets. Assets are anything of value that you own, which can be converted into cash. Here’s how you can identify and value your assets:

Common Types of Assets

- Cash and cash equivalents: This includes money you have in your bank accounts, cash on hand, and any liquid assets.

- Investments: Stocks, bonds, mutual funds, retirement accounts, and other investments you hold.

- Real estate: The value of your home, rental properties, or any other real estate you own.

- Personal property: This encompasses valuable items like jewelry, art, vehicles, and collectibles.

- Business interests: If you own a business or have equity in a company, this is considered an asset.

Assigning Values to Assets

Assigning values to different assets can be tricky. For assets like cash and investments, you can use their current market value. Real estate can be valued based on recent appraisals or market trends. Personal property values can be a bit more subjective, but you can use estimates or professional appraisals to determine their worth.

Tips for Including All Assets

- Don’t forget about assets that may not be as obvious, such as valuable collections or intellectual property.

- Regularly update the values of your assets to ensure an accurate net worth calculation.

- Consider seeking professional help, especially for complex assets like business interests or unique personal property.

- Remember to include all debts and liabilities when calculating your net worth to get a true picture of your financial health.

Determining Liabilities

Determining liabilities is a crucial step in calculating net worth as it provides a clear picture of the financial obligations that need to be accounted for. Liabilities are debts or financial obligations that an individual or entity owes to others.

Types of Liabilities

- Credit card debt

- Student loans

- Mortgage

- Car loans

- Personal loans

Liabilities such as credit card debt and loans are subtracted from assets to determine net worth.

Accounting for Liabilities

When calculating net worth, it is essential to accurately list all liabilities and their respective amounts. This includes both short-term and long-term liabilities. Short-term liabilities are debts that are due within a year, while long-term liabilities are debts with a longer repayment period.

Impact of Liabilities on Net Worth

Liabilities have a direct impact on net worth as they reduce the total value of assets. The higher the liabilities, the lower the net worth will be. It is crucial to manage liabilities effectively to maintain a healthy financial standing and increase overall net worth.

Evaluating Net Worth Changes

When evaluating net worth changes, it is important to consider various factors that can influence the overall value of your assets and liabilities. Understanding these factors can help you make informed decisions about your finances.

Factors Influencing Net Worth Changes

- Income Changes: Increases in income from salary raises, bonuses, or investments can lead to a higher net worth.

- Asset Appreciation: If the value of your investments, real estate, or other assets increases, your net worth will also go up.

- Debt Reduction: Paying off debts like loans or credit card balances decreases your liabilities, positively impacting your net worth.

- Spending Habits: Overspending or accumulating more debt can result in a decrease in net worth over time.

Scenarios of Net Worth Changes

- If you receive a promotion at work with a higher salary, your net worth will likely increase due to the additional income.

- On the other hand, if you take on more debt without a corresponding increase in assets, your net worth may decrease.

Benefits of Tracking Net Worth Over Time

By monitoring your net worth regularly, you can:

- Track your financial progress and set goals for improvement.

- Identify areas where you can make adjustments to increase your net worth.

- Stay motivated to save and invest wisely to build wealth over time.