Ready to take control of your financial future? In this guide on how to build wealth, we’ll explore key strategies and techniques to help you achieve your money goals and secure a prosperous future.

From setting financial goals to smart investing and managing debt, this comprehensive overview will equip you with the knowledge and tools needed to build a solid foundation for long-term wealth accumulation.

Setting Financial Goals

Setting financial goals is crucial when it comes to building wealth. It gives you a clear direction and purpose for your money, helping you stay focused and motivated on your journey to financial success.

Importance of Setting Clear Financial Goals

- Allows you to prioritize your spending and saving habits.

- Helps you track your progress and make adjustments as needed.

- Provides a roadmap for achieving your desired financial outcomes.

Specific Financial Goals for Wealth Building

Short-term and long-term financial goals play a key role in wealth accumulation. Here are some examples:

- Short-term Financial Goals:

- Save $500 for an emergency fund within the next three months.

- Pay off $1,000 in credit card debt by the end of the year.

- Contribute 5% of your income to a retirement account each month.

- Long-term Financial Goals:

- Buy a home within the next five years with a 20% down payment.

- Invest $10,000 in a diversified portfolio for retirement in the next decade.

- Generate $1,000 per month in passive income streams within the next 15 years.

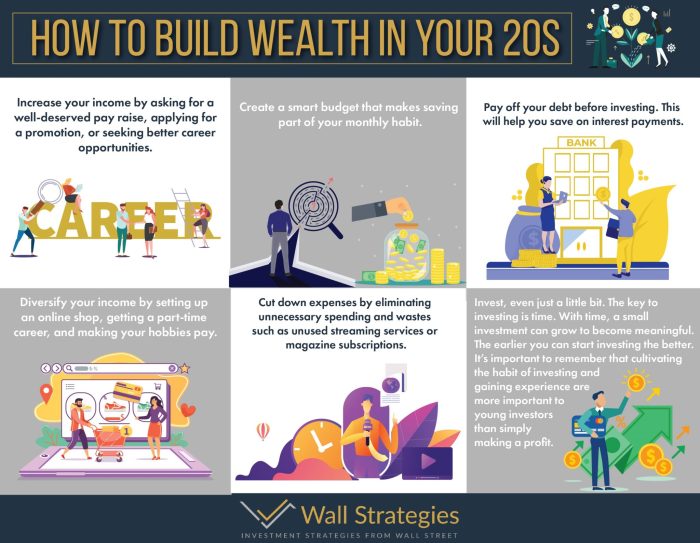

Budgeting and Saving

Budgeting and saving are crucial components in building wealth. By effectively managing your finances and setting aside money for the future, you can pave the way for financial stability and growth.

Creating an effective budget starts with understanding your income and expenses. Take the time to track your spending habits and identify areas where you can cut back. Set realistic financial goals and allocate funds towards savings, investments, and debt repayment.

Tips for Creating an Effective Budget

- Start by calculating your total monthly income, including wages, bonuses, and any other sources of income.

- List out all your expenses, from fixed costs like rent and utilities to variable expenses such as groceries and entertainment.

- Differentiate between needs and wants to prioritize essential expenses while cutting back on non-essential purchases.

- Set aside a portion of your income for savings and emergencies, aiming to build an emergency fund that can cover 3-6 months’ worth of expenses.

- Track your spending regularly and make adjustments to your budget as needed to ensure you stay on track towards your financial goals.

Methods for Saving Money

- Automated Savings: Set up automatic transfers from your checking account to a savings account to ensure consistent savings without the need for manual intervention.

- Frugal Living: Cut back on unnecessary expenses by adopting a frugal lifestyle, such as cooking at home, using coupons, and avoiding impulse purchases.

- Investing: Allocate a portion of your savings towards investments like stocks, bonds, or real estate to grow your wealth over time.

- Debt Repayment: Prioritize paying off high-interest debts to free up more funds for savings and investments.

- Emergency Fund: Build a safety net by setting aside money for unexpected expenses, reducing the need to dip into savings or incur debt during emergencies.

Investing Wisely

Investing plays a crucial role in wealth creation by allowing individuals to grow their money over time through various financial instruments. It involves putting money into assets with the expectation of generating a profit in the future.

Types of Investments

- Stocks: Investing in shares of companies, which offer ownership in the company and the potential for capital appreciation.

- Bonds: Loans made to governments or corporations in exchange for periodic interest payments and the return of the initial investment at maturity.

- Real Estate: Investing in physical properties such as houses, apartments, or commercial buildings for rental income or capital appreciation.

- Mutual Funds: Pooled funds from multiple investors used to invest in a diversified portfolio of stocks, bonds, or other securities managed by a professional fund manager.

It’s important to diversify your investments across different asset classes to spread risk and maximize returns.

Minimizing Risks

- Research: Conduct thorough research on the investments you are considering to understand the risks and potential returns.

- Diversification: Spread your investments across various assets to reduce the impact of any single investment performing poorly.

- Long-Term Approach: Adopt a long-term investment strategy to ride out market fluctuations and benefit from compounding returns.

- Risk Tolerance: Assess your risk tolerance and invest accordingly to ensure you can withstand any market volatility.

Generating Additional Income

In the journey to building wealth, having multiple income streams is crucial as it provides financial security and stability. By diversifying your income sources, you can protect yourself from unexpected financial setbacks and increase your overall wealth.

Passive Income Sources

Passive income sources are a great way to generate additional income with minimal effort once they are set up. Some examples of passive income sources include rental properties, dividends from investments, royalties from creative work, and interest from savings accounts or bonds.

Side Hustles for Increasing Wealth

Side hustles are another effective way to boost your income and accelerate your wealth-building journey. By taking on a side gig or starting a small business in your spare time, you can increase your earnings and potentially turn your passion into a profitable venture. Popular side hustles include freelance work, tutoring, pet sitting, selling handmade goods online, and driving for ride-sharing services like Uber or Lyft.

Debt Management

Debt can have a significant impact on wealth accumulation, as it can hinder your ability to save, invest, and grow your assets. High levels of debt can lead to financial stress, limited opportunities, and a cycle of borrowing to cover existing debts. Effective debt management is crucial for building wealth and achieving financial stability.

Impact of Debt on Wealth Accumulation

Debt can eat away at your income through interest payments, reducing the amount of money you have available for saving and investing. It can also lower your credit score, making it harder to access favorable loan terms or financial opportunities. Additionally, carrying high levels of debt can limit your ability to take risks or capitalize on investment opportunities that could grow your wealth over time.

Strategies for Managing and Reducing Debt

- Create a budget to track your expenses and identify areas where you can cut back to allocate more money towards debt repayment.

- Focus on paying off high-interest debt first to reduce the amount of interest you pay over time.

- Consider debt consolidation or refinancing options to lower your interest rates and simplify your debt repayment process.

- Negotiate with creditors to see if you can lower your interest rates or work out a more manageable repayment plan.

Difference Between Good Debt and Bad Debt

- Good debt is typically used to finance assets that have the potential to increase in value over time, such as a mortgage for a home or a loan for education that can lead to higher earning potential.

- Bad debt, on the other hand, is used to finance depreciating assets or non-essential expenses, such as credit card debt for luxury items or high-interest loans for vacations.

Continuous Learning and Skill Development

Continuous learning and skill development are essential components of building wealth in the long run. By investing in education and acquiring new skills, individuals can increase their earning potential, stay competitive in the job market, and adapt to changing economic conditions.

Investing in Self-Improvement

One way to invest in self-improvement for long-term financial growth is to pursue higher education or professional certifications that are in demand. This can open up new career opportunities and increase earning potential.

- Attend workshops, seminars, and online courses to stay updated on industry trends and best practices.

- Read books and articles on personal finance, investing, and entrepreneurship to expand knowledge and skills.

- Join networking events and professional organizations to connect with like-minded individuals and learn from experts in the field.

Adapting to Market Trends

It is crucial to adapt to market trends and acquire new skills to remain relevant and competitive in today’s fast-paced economy.

Remember, the only constant in life is change. Embrace it and use it to your advantage.

- Identify emerging industries and technologies and invest time in learning about them.

- Take advantage of online platforms offering courses on a wide range of topics to continuously upskill and reskill.

- Seek mentorship from industry veterans to gain insights and guidance on navigating market shifts.