Exploring the ins and outs of building credit, this introduction dives into the significance of establishing a solid credit history, the impact it can have on your financial future, and why it’s never too early to start building credit.

In the following paragraphs, we will delve into the fundamentals of credit scores, various methods to build credit, tips for maintaining a good credit standing, and the importance of staying on top of your credit report.

Introduction to Building Credit

Building credit is a crucial step in achieving financial stability and success. It involves establishing a positive credit history that demonstrates your ability to manage credit responsibly.

Having good credit can open up a world of financial opportunities for you. It can help you qualify for lower interest rates on loans, credit cards, and mortgages, saving you money in the long run. Good credit can also make it easier to rent an apartment, buy a car, or even land your dream job.

Importance of Building Credit Early

Starting to build credit early is essential for establishing a solid financial foundation for the future. The longer your credit history, the more trustworthy you appear to lenders, making it easier to access credit when you need it most. By starting early, you can also avoid common pitfalls that can damage your credit score and set yourself up for financial success.

Understanding Credit Scores

A credit score is a three-digit number that represents a person’s creditworthiness. It is calculated based on the information in a credit report.

Factors that affect a credit score include:

Factors Affecting Credit Score

- Payment history: This is the most significant factor, accounting for about 35% of your credit score. It reflects your history of paying bills on time.

- Credit utilization: This is the amount of credit you are currently using compared to your total available credit. Keeping this ratio low can positively impact your credit score.

- Length of credit history: The longer you have had credit accounts open, the better it is for your credit score.

- Credit mix: Having a mix of different types of credit, such as credit cards, loans, and mortgages, can positively impact your credit score.

- New credit: Opening multiple new credit accounts in a short period can negatively impact your credit score.

Good vs. Bad Credit Score

A good credit score typically ranges from 700 to 850, while a bad credit score is usually below 600. Having a good credit score makes it easier to qualify for loans, credit cards, and better interest rates. On the other hand, a bad credit score can limit your financial opportunities and lead to higher interest rates or denial of credit.

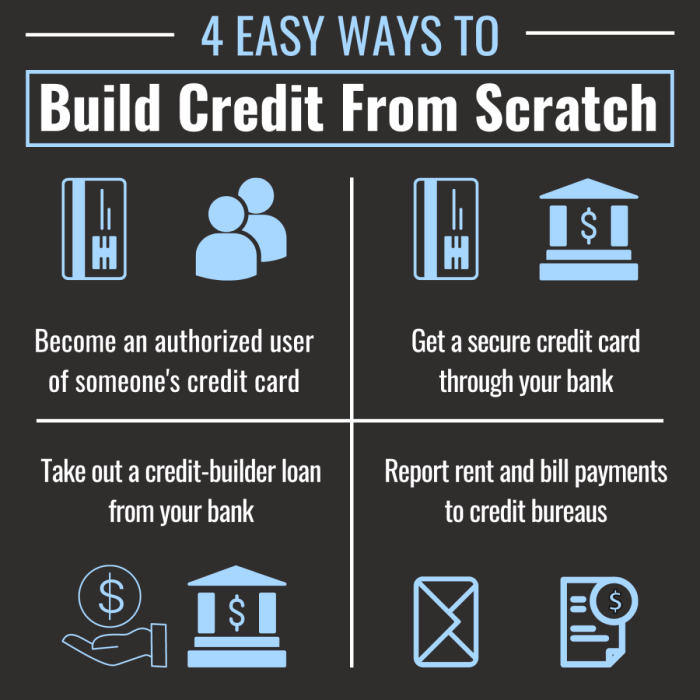

Ways to Build Credit

Building credit is essential for financial stability and future opportunities. By establishing a positive credit history, you can access better loan terms, lower interest rates, and more opportunities for financial growth.

1. Paying Bills On Time

One of the most important ways to build credit is by paying your bills on time. Your payment history makes up a significant portion of your credit score, so ensuring that you pay your bills by their due dates is crucial for a good credit standing.

2. Opening a Credit Card

Another effective way to start building credit is by opening a credit card. By using a credit card responsibly and making timely payments, you can establish a positive credit history. Start with a secured credit card if you have no credit history or a low credit score.

Tips for Maintaining Good Credit

Maintaining a good credit score is essential for financial health and future opportunities. By following these strategies, you can ensure that your credit remains strong and favorable.

Impact of Credit Utilization

Credit utilization refers to the amount of credit you are using compared to the total amount available to you. High credit utilization can negatively impact your credit score. It is recommended to keep your credit utilization below 30% to maintain a good credit score.

Monitoring Credit Reports

Regularly monitoring your credit reports can help you identify any errors or fraudulent activity that may be impacting your credit score. By staying informed about your credit status, you can take necessary actions to address any issues and maintain good credit.