Get ready to dive into the world of financial planning for retirement with a fresh perspective that combines knowledge and style. As we explore the ins and outs of securing your financial future, you’ll discover the keys to a successful retirement plan that’s both smart and savvy.

Let’s break down the essentials of financial planning for retirement and navigate through the complexities with ease.

Importance of Financial Planning for Retirement

Financial planning for retirement is crucial for ensuring financial security and stability during the later years of life. It allows individuals to save and invest wisely, ensuring they have enough funds to cover living expenses, healthcare costs, and other needs during retirement.

Benefits of Early Retirement Planning

- Compound interest: By starting early, individuals can take advantage of compound interest, allowing their savings to grow exponentially over time.

- Lower risk: Early retirement planning gives individuals more time to recover from financial setbacks or market fluctuations, reducing the overall risk of running out of money during retirement.

- Peace of mind: Knowing that you have a solid financial plan in place can provide peace of mind and reduce stress about the future.

Percentage of People Who Have Not Saved Enough for Retirement

According to a recent study, approximately 45% of Americans have not saved anything for retirement, while around 33% have less than $10,000 saved. This highlights the importance of starting retirement planning early and saving consistently to avoid financial struggles later in life.

Types of Retirement Accounts

When planning for retirement, it’s essential to understand the different types of retirement accounts available to you. Each type comes with its own set of rules, benefits, and tax implications.

401(k)

A 401(k) is a retirement account offered by employers where employees can contribute a portion of their pre-tax income. Some employers also match a percentage of these contributions. The money in a 401(k) grows tax-deferred until withdrawal during retirement.

IRA (Individual Retirement Account)

An IRA is a retirement account that individuals can set up on their own. There are traditional IRAs, where contributions may be tax-deductible, and Roth IRAs, where contributions are made with after-tax dollars. Both types allow investments to grow tax-free until retirement.

Roth IRA

A Roth IRA is funded with after-tax dollars, meaning withdrawals in retirement are tax-free. This type of account is ideal for those who expect to be in a higher tax bracket during retirement.

Tax Implications

- 401(k): Contributions are made with pre-tax dollars, reducing taxable income. Withdrawals in retirement are taxed as ordinary income.

- IRA: Traditional IRA contributions may be tax-deductible, and withdrawals are taxed as ordinary income. Roth IRA contributions are made with after-tax dollars, and withdrawals are tax-free.

Contribution Growth Examples

For example, if you contribute $5,000 per year to a 401(k) with a 7% annual return, after 30 years, you could have over $430,000 saved for retirement.

Similarly, contributing $6,000 annually to a Roth IRA with a 6% annual return could grow to over $315,000 in 25 years.

Creating a Retirement Budget

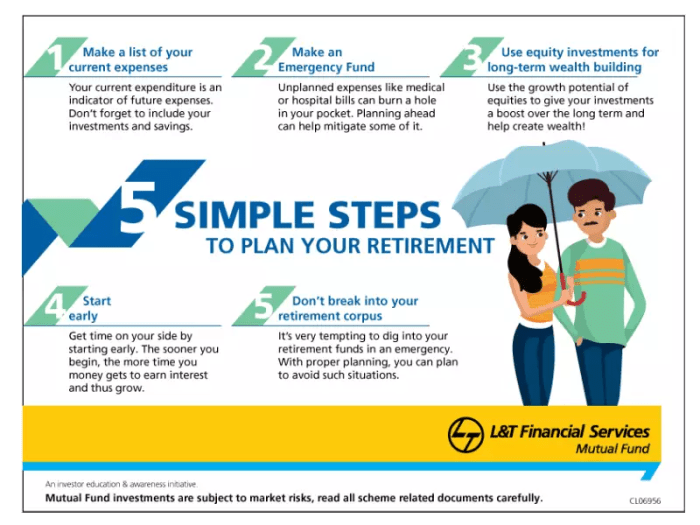

Planning for retirement involves creating a budget to ensure financial stability during your golden years. Here are the key steps to follow:

Estimating Post-Retirement Expenses

After retiring, your expenses may change. Consider the following factors when estimating post-retirement expenses:

- Healthcare Costs: As you age, healthcare expenses tend to increase. Account for medical insurance, prescriptions, and potential long-term care.

- Lifestyle Choices: Your spending habits may shift in retirement. Factor in leisure activities, travel plans, and hobbies.

- Housing Expenses: Evaluate whether you plan to downsize, relocate, or stay in your current home. Include property taxes, maintenance, and utilities.

- Debts and Loans: Aim to settle outstanding debts before retirement to minimize financial burdens.

Adjusting Spending Habits

To meet retirement savings goals, consider these tips for adjusting your spending habits:

- Track Expenses: Monitor your current spending to identify areas where you can cut back or reallocate funds to savings.

- Set Priorities: Determine what expenses are essential versus discretionary. Focus on covering necessities first.

- Create a Realistic Budget: Develop a budget that aligns with your retirement income, accounting for both fixed and variable expenses.

- Seek Financial Advice: Consult with a financial advisor to optimize your budget and savings strategy for retirement.

Investment Strategies for Retirement

When it comes to planning for retirement, having the right investment strategies in place is crucial to ensure financial security in your golden years. Let’s dive into some key aspects of investment strategies for retirement.

Asset Allocation in Retirement Planning

Asset allocation is the process of spreading your investment funds across different types of assets, such as stocks, bonds, and real estate, to help manage risk and optimize returns. By diversifying your investments, you can reduce the impact of market volatility on your portfolio. It’s essential to consider your risk tolerance, time horizon, and financial goals when determining the right asset allocation for your retirement plan.

Various Investment Options for Retirement Savings

- Stocks: Investing in stocks can offer high returns over the long term, but they also come with higher volatility and risk. It’s important to research and select individual stocks or invest in diversified stock funds.

- Bonds: Bonds are considered a safer investment option compared to stocks, providing a steady stream of income through interest payments. They can help balance the risk in your investment portfolio.

- Real Estate: Investing in real estate, such as rental properties or Real Estate Investment Trusts (REITs), can provide a source of passive income and potential appreciation in property value.

The Importance of Diversification in a Retirement Investment Portfolio

Diversification involves spreading your investments across different asset classes and industries to minimize risk. By diversifying your retirement investment portfolio, you can reduce the impact of a downturn in any single investment. It’s crucial to maintain a well-balanced portfolio that aligns with your risk tolerance and financial objectives to ensure long-term growth and stability.

Social Security and Retirement Planning

When it comes to retirement planning, Social Security benefits play a crucial role in providing financial support during your golden years. Understanding how to maximize these benefits can make a significant difference in your overall retirement strategy.

How Social Security Benefits Factor into Retirement Planning

Social Security benefits are designed to provide a source of income for retirees once they reach a certain age. These benefits are based on your earnings history and the age at which you choose to start receiving them. It’s important to factor in these benefits when creating your retirement budget and investment plan.

Implications of Early vs. Delayed Social Security Claiming

Claiming Social Security benefits early can result in lower monthly payments, while delaying claiming can lead to increased benefits. The decision between early or delayed claiming depends on various factors such as your health, financial situation, and retirement goals. It’s essential to weigh these implications carefully before making a decision.

Strategies for Maximizing Social Security Benefits in Retirement

There are several strategies you can employ to maximize your Social Security benefits in retirement. These include delaying claiming benefits to increase monthly payments, coordinating benefits with your spouse, and considering your overall retirement income needs. By optimizing your Social Security strategy, you can enhance your financial security in retirement.

Healthcare Costs in Retirement

As you plan for retirement, it’s crucial to consider the impact of healthcare costs on your financial well-being. Healthcare expenses can significantly affect your retirement savings and overall quality of life, making it essential to prepare adequately.

Factoring in Long-Term Care Expenses

Long-term care expenses, such as nursing home care or in-home assistance, can be substantial and are often not covered by traditional healthcare plans or Medicare. It’s important to factor in these potential costs when planning for retirement to avoid any financial strain later on.

Financial Preparation for Healthcare Costs

- Start saving early: Begin setting aside funds specifically for healthcare costs in retirement to build a financial cushion.

- Consider long-term care insurance: Investing in a long-term care insurance policy can help cover expenses that may not be included in traditional healthcare plans.

- Research healthcare options: Explore different healthcare plans and providers to find the most cost-effective solutions for your needs.

- Create a healthcare budget: Develop a budget that includes anticipated healthcare expenses to better plan for future costs.