Dividend payout ratios set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

Understanding dividend payout ratios is like discovering the hidden gems of the financial world, where numbers speak volumes and decisions are made with precision.

Understanding Dividend Payout Ratios

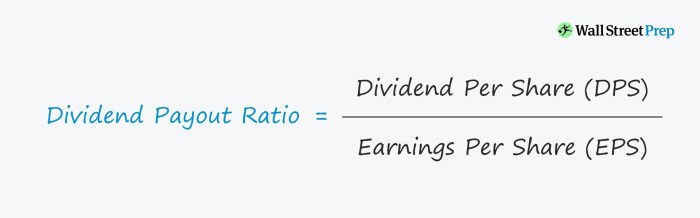

Dividend payout ratios are a financial metric used to measure the percentage of earnings paid out to shareholders in the form of dividends. This ratio is calculated by dividing the total dividends paid by the company by its net income. It provides insight into how much of the company’s profits are being distributed to shareholders versus being retained for reinvestment or other uses.

High and Low Dividend Payout Ratios

High dividend payout ratios indicate that a company is distributing a large portion of its earnings to shareholders, leaving less for reinvestment in the business. This may be attractive to income-seeking investors but could limit the company’s ability to grow. Examples of companies with high dividend payout ratios include utility companies and real estate investment trusts (REITs).

On the other hand, low dividend payout ratios suggest that a company is retaining more of its earnings for growth opportunities. While this may be less appealing to income investors, it allows the company to reinvest in operations, research, and development. Technology companies like Amazon and Google often have low dividend payout ratios.

Significance of Dividend Payout Ratios

Dividend payout ratios are essential for both investors and companies. For investors, a high ratio may indicate stable returns and income generation, while a low ratio may suggest growth potential. For companies, maintaining an appropriate dividend payout ratio is crucial for balancing shareholder returns with reinvestment in the business to drive future growth. It also reflects the company’s financial health and management’s strategic decisions.

Factors Influencing Dividend Payout Ratios

When it comes to dividend payout ratios, there are several key factors that can influence how much a company decides to pay out to its shareholders. Let’s take a closer look at these factors and how they impact dividend payout ratios.

Company Profitability

Company profitability plays a significant role in determining dividend payout ratios. A company that is profitable and has a strong financial performance is more likely to have higher dividend payout ratios. This is because a profitable company has the necessary funds to distribute among its shareholders while still retaining enough for future growth and investment opportunities.

- Companies with consistent earnings growth tend to have higher dividend payout ratios as they can afford to reward their shareholders.

- On the other hand, companies experiencing financial difficulties or losses may have lower or no dividend payouts as they need to focus on improving their financial health.

Role of Industry Norms and Company Growth Prospects

Industry norms and company growth prospects also play a crucial role in determining dividend payout ratios. Companies often look at what other companies in the same industry are doing in terms of dividend payouts to remain competitive and attract investors.

Understanding industry benchmarks and trends can help companies set appropriate dividend payout ratios that align with market expectations.

- High-growth companies may opt to reinvest their profits back into the business instead of paying high dividends to fuel further expansion.

- In contrast, mature companies with stable growth prospects may choose to distribute a higher percentage of their earnings as dividends to reward shareholders for their investment.

Importance of Dividend Payout Ratios

When it comes to investing, dividend payout ratios play a crucial role in helping investors make informed decisions. These ratios provide valuable insights into the financial health and stability of a company, giving investors a better understanding of how much of the profits are being distributed to shareholders.

Comparison with Other Financial Metrics

Dividend payout ratios are often compared with other financial metrics like earnings per share (EPS) and price-to-earnings (P/E) ratios. While EPS and P/E ratios focus on the profitability and valuation of a company, dividend payout ratios offer a unique perspective by looking at how much of the earnings are being returned to shareholders in the form of dividends.

Reflection of Financial Health

Dividend payout ratios can be a reflection of a company’s financial health and stability. A high dividend payout ratio may indicate that a company is confident in its ability to generate consistent profits and reward its shareholders. On the other hand, a low dividend payout ratio could suggest that a company is retaining more earnings for future growth and expansion.

Interpreting Dividend Payout Ratios

When it comes to interpreting dividend payout ratios, understanding the implications of high and low ratios is crucial for investors. Let’s dive into the guidelines on how to interpret these ratios effectively.

Interpreting High and Low Dividend Payout Ratios

- A high dividend payout ratio typically indicates that a company is distributing a large portion of its earnings to shareholders. This could be a positive sign for income-seeking investors, as it shows a commitment to returning profits.

- On the other hand, a low dividend payout ratio may suggest that a company is retaining more earnings for reinvestment back into the business. While this could lead to potential growth opportunities, it may disappoint investors looking for immediate returns.

Implications of Changes in Dividend Payout Ratios Over Time

- Significant changes in dividend payout ratios over time can provide valuable insights into a company’s financial health and stability. A sudden increase in the ratio may indicate that the company is confident in its future cash flows and profitability.

- Conversely, a decrease in the ratio could signal financial distress or a shift in the company’s strategic priorities. It’s essential for investors to monitor these changes closely to assess the company’s performance.

Fluctuating Dividend Payout Ratios and Investor Outcomes

- When a company’s dividend payout ratio fluctuates, it can have different implications for investors depending on the underlying reasons. For example, if the ratio increases due to improved earnings and cash flow, investors may view it positively as a sign of strength.

- However, if the ratio fluctuates due to inconsistent earnings or financial challenges, investors may become wary of the company’s ability to sustain dividend payments in the long run. It’s essential to analyze the reasons behind these fluctuations to make informed investment decisions.