Dive into the world of credit score ranges explained, where understanding the nuances of these numbers can make all the difference in your financial journey. From deciphering the various ranges to mastering ways to boost your score, this guide has got you covered. Get ready to unlock the secrets behind credit scores and take control of your financial well-being.

As we delve deeper, you’ll uncover the essential factors that shape your credit score, learn how to navigate through different credit score ranges, and discover actionable tips to elevate your financial standing.

Credit Score Ranges Overview

When it comes to understanding your credit health, knowing about credit score ranges is key. Your credit score is a three-digit number that represents your creditworthiness to potential lenders, making it a crucial factor in determining whether you qualify for loans, credit cards, or favorable interest rates.

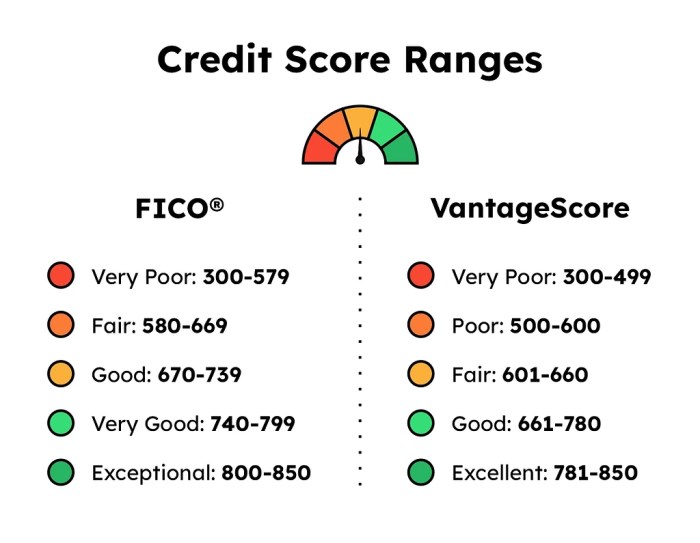

Typical Credit Score Ranges

- 300-579: Poor

- 580-669: Fair

- 670-739: Good

- 740-799: Very Good

- 800-850: Excellent

Remember, the higher your credit score, the better your chances of getting approved for credit and securing lower interest rates.

Importance of Understanding Credit Score Ranges

Having a grasp of credit score ranges is crucial for maintaining good financial health. It allows you to monitor your credit standing, identify areas for improvement, and take steps to boost your score over time. Additionally, understanding credit score ranges helps you set realistic financial goals and make informed decisions when it comes to borrowing money.

Factors Influencing Credit Scores

When it comes to credit scores, several key factors play a crucial role in determining an individual’s creditworthiness. Understanding these factors is essential for maintaining a healthy credit score and financial well-being.

Payment History

Payment history is one of the most significant factors influencing credit scores. It reflects how consistently a person makes on-time payments towards their debts. Late payments, defaults, or accounts in collections can significantly lower a credit score. For example, missing a credit card payment or defaulting on a loan can have a negative impact on your credit score.

Credit Utilization

Credit utilization refers to the amount of credit you are currently using compared to the total credit available to you. High credit utilization ratios can indicate financial strain and may lead to a lower credit score. For instance, maxing out credit cards or carrying high balances can negatively impact your credit score.

Length of Credit History

The length of your credit history plays a role in determining your credit score. A longer credit history demonstrates a track record of responsible credit use, which can positively impact your credit score. Opening new accounts frequently can shorten your average account age and potentially lower your credit score.

New Credit

Opening multiple new credit accounts within a short period can signal risk to lenders and impact your credit score negatively. Each new credit application can result in a hard inquiry on your credit report, which may lower your score temporarily. For example, applying for several credit cards or loans in a short timeframe can lower your credit score.

Credit Mix

Having a diverse credit mix, such as a combination of credit cards, installment loans, and a mortgage, can positively impact your credit score. It demonstrates your ability to manage different types of credit responsibly. However, relying heavily on one type of credit, such as credit cards, may limit the positive impact on your credit score.

Understanding Credit Score Ranges

When it comes to credit scores, it’s essential to understand the different ranges and what they mean for your financial health. Lenders use these ranges to assess your creditworthiness and determine the terms of any credit you may apply for.

Let’s break down the various credit score ranges:

Poor Credit Score Range

- A credit score below 580 is typically considered poor.

- Individuals in this range may have a history of missed payments, defaulting on loans, or high levels of debt.

- Lenders may view those with poor credit as high-risk borrowers and may offer them credit with high-interest rates or require collateral.

Fair Credit Score Range

- A credit score between 580 and 669 falls into the fair range.

- People in this category may have a mix of positive and negative credit history, such as late payments or carrying high credit card balances.

- Lenders may still consider individuals with fair credit as higher risk but may offer them credit at more moderate rates.

Good Credit Score Range

- Credit scores between 670 and 739 are considered good.

- Individuals in this range typically have a history of making payments on time and managing their credit responsibly.

- Lenders see those with good credit as less risky and may offer them credit at competitive interest rates.

Very Good Credit Score Range

- A credit score between 740 and 799 falls into the very good range.

- People in this category have a strong credit history with very few, if any, negative marks.

- Lenders view individuals with very good credit as low risk and may offer them credit at the best interest rates available.

Excellent Credit Score Range

- Any credit score above 800 is considered excellent.

- Those with excellent credit have a near-perfect credit history, showing responsible credit management and low credit utilization.

- Lenders see individuals with excellent credit as extremely low risk and may offer them the most favorable terms on loans and credit lines.

Improving Credit Scores

To improve credit scores, individuals can take specific steps tailored to their current credit score range. By implementing these strategies, they can gradually enhance their creditworthiness and open up more financial opportunities in the future.

Improving Poor Credit Scores

- Start by checking your credit report for any errors or fraudulent activity. Dispute inaccuracies to ensure your credit report reflects correct information.

- Make timely payments on all accounts to show creditors that you are responsible with your financial obligations.

- Consider applying for a secured credit card to establish a positive payment history and improve your credit utilization ratio.

- Work with a credit counselor to create a debt repayment plan and budget that can help you pay off outstanding debts.

Improving Fair Credit Scores

- Continue making on-time payments and aim to pay more than the minimum amount due to reduce overall debt.

- Reduce credit card balances to lower your credit utilization ratio, which can positively impact your credit score.

- Avoid opening multiple new accounts within a short period, as this can lower the average age of your credit accounts.

- Consider becoming an authorized user on someone else’s credit card with a good payment history to boost your score.

Improving Good Credit Scores

- Maintain a mix of credit types, including credit cards, loans, and mortgages, to demonstrate responsible credit management.

- Monitor your credit regularly to catch any potential issues early and take corrective action promptly.

- Avoid closing old credit accounts, as this can shorten your credit history and potentially lower your score.

- Continue to make on-time payments and keep credit card balances low to sustain a good credit score.