Budgeting techniques set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. From traditional methods to advanced strategies, this guide will delve into the world of budgeting with a fresh perspective that will leave you inspired and informed.

Overview of Budgeting Techniques

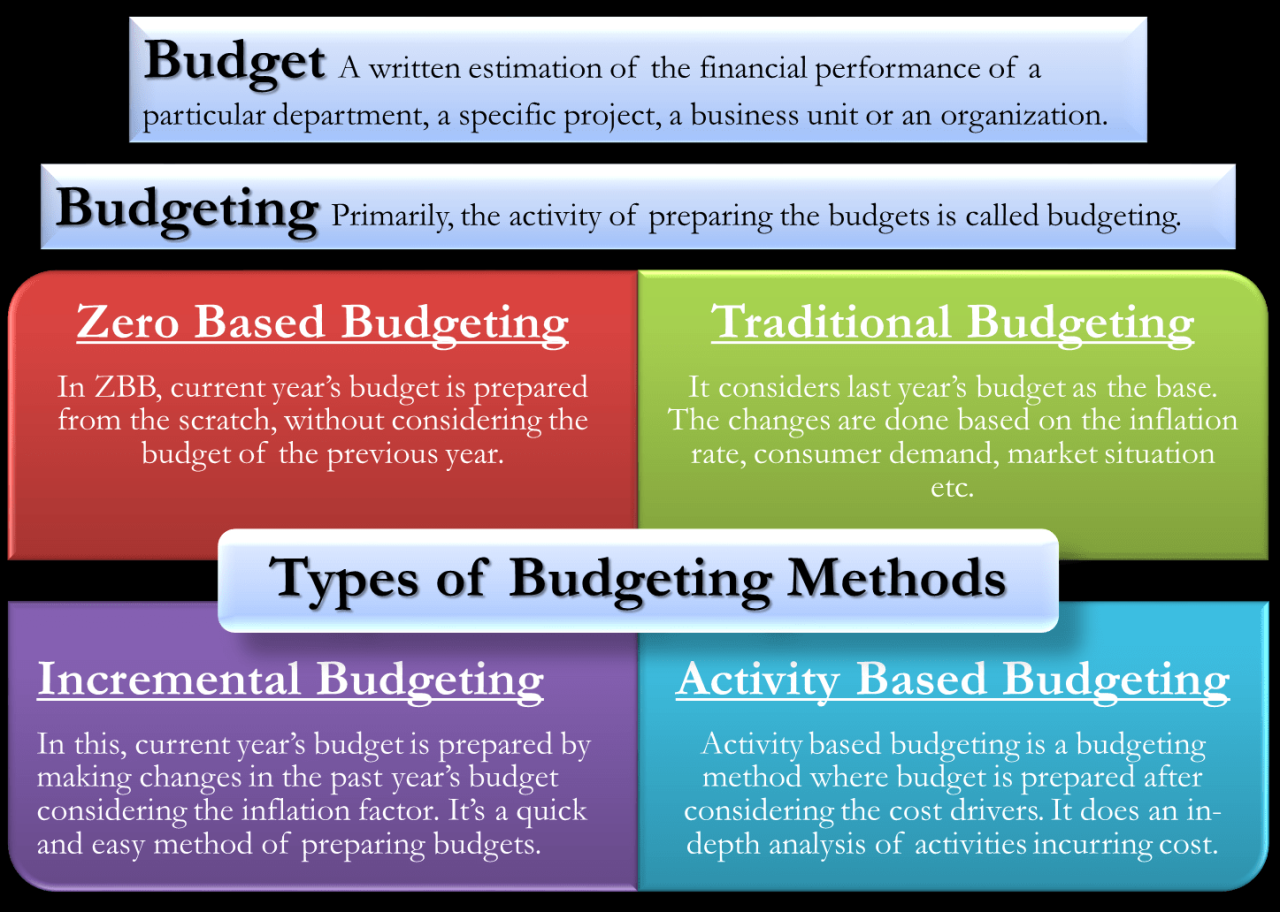

Budgeting is a crucial aspect of personal finance as it helps individuals and businesses track their income and expenses, plan for the future, and achieve financial goals.

Types of Budgeting Techniques

- The 50/30/20 Rule: This technique suggests allocating 50% of income to needs, 30% to wants, and 20% to savings and debt repayment.

- Zero-Based Budgeting: Every dollar of income is assigned a specific purpose, ensuring that there is no unallocated money left over.

- Envelope System: Cash is divided into envelopes for different spending categories, helping to control expenses and avoid overspending.

Benefits of Effective Budgeting Techniques

- Financial Discipline: Budgeting promotes responsible spending habits and helps individuals avoid unnecessary purchases.

- Goal Achievement: Setting financial goals becomes easier with a budget in place, as it allows for tracking progress and making adjustments as needed.

- Emergency Preparedness: By having a budget, individuals can set aside funds for emergencies or unexpected expenses, providing peace of mind.

Traditional Budgeting Methods

Traditional budgeting methods have been used for many years to help individuals manage their finances effectively. Two common traditional budgeting methods include the envelope system and zero-based budgeting.

The envelope system is a simple yet effective method where you allocate a specific amount of cash to different categories of expenses and place the cash in separate envelopes. For example, you may have envelopes for groceries, entertainment, and gas. Once the cash in each envelope is gone, you stop spending in that category. This method helps you visually see how much you have left to spend and prevents overspending.

The Envelope System

- Allocate cash into different envelopes for specific spending categories.

- Visual representation of available funds for each category.

- Prevents overspending by limiting spending to the cash in each envelope.

Zero-based budgeting is another traditional method where you assign every dollar a specific purpose, ensuring that your income minus expenses equals zero. This approach requires you to track every expense and allocate funds based on your income, giving every dollar a job to do. This method helps you prioritize spending and eliminate any unnecessary expenses.

Zero-Based Budgeting

- Assign every dollar a specific purpose to ensure income minus expenses equals zero.

- Track every expense and allocate funds based on income.

- Prioritize spending and eliminate unnecessary expenses.

While traditional budgeting methods like the envelope system and zero-based budgeting have their advantages in providing a structured approach to managing finances and promoting better spending habits, they may also have disadvantages. These methods can be time-consuming to maintain, especially for those who prefer digital tools over manual tracking. Additionally, they may not account for unexpected expenses or changes in income, leading to potential budgeting challenges.

Overall, the key to successful budgeting lies in finding a method that works best for your financial situation and lifestyle, whether it be a traditional approach like the envelope system or zero-based budgeting, or a more modern digital tool. It’s important to regularly review and adjust your budget to ensure it aligns with your financial goals and priorities.

Technology-Based Budgeting Tools

In today’s digital age, technology has transformed the way people manage their finances, including budgeting. With the rise of various budgeting apps and software, individuals now have access to powerful tools to help them track their expenses, set financial goals, and ultimately take control of their money.

Popular Budgeting Apps and Software

- Mint: Mint is a popular budgeting app that allows users to link their bank accounts, track spending, set budget goals, and receive alerts for upcoming bills.

- You Need a Budget (YNAB): YNAB is a budgeting software that focuses on giving every dollar a job. It helps users prioritize their spending, save for specific goals, and get out of debt.

- Personal Capital: Personal Capital is more than just a budgeting app; it also offers investment tracking and retirement planning tools. Users can see a holistic view of their finances in one place.

Revolutionizing Budget Management

Technology-based budgeting tools have revolutionized the way people manage their budgets by providing real-time updates on spending, offering personalized insights, and automating processes that used to be manual. These tools make it easier for individuals to see where their money is going, identify areas for improvement, and make informed financial decisions.

Features and Benefits of Using Technology-Based Budgeting Tools

- Automatic categorization of expenses: Many budgeting apps can categorize expenses automatically, saving users time and effort.

- Customizable budget goals: Users can set personalized budget goals based on their unique financial situation and priorities.

- Visual representations of financial data: Technology-based budgeting tools often provide visual charts and graphs to help users understand their financial data at a glance.

- Syncing across devices: Users can access their budgeting information from multiple devices, making it convenient to track expenses on the go.

Advanced Budgeting Strategies

Budgeting is not just about tracking expenses; it also involves strategic planning to maximize financial resources. Advanced budgeting strategies like value-based budgeting, the 50/30/20 rule, and creating a flexible budget can help individuals achieve their financial goals more effectively.

Value-Based Budgeting

Value-based budgeting focuses on aligning expenses with personal values and priorities. It involves identifying what is most important to you and allocating resources accordingly. By prioritizing spending based on what brings you the most satisfaction or fulfillment, you can ensure that your money is used in a way that reflects your values and goals.

50/30/20 Rule

The 50/30/20 rule is a popular budgeting guideline that suggests allocating your after-tax income as follows:

- 50% for Needs: Essentials like rent, utilities, groceries, and minimum debt payments.

- 30% for Wants: Non-essential expenses like dining out, entertainment, shopping, and hobbies.

- 20% for Savings and Debt Repayment: Building an emergency fund, saving for retirement, and paying off debt.

Following this rule can help individuals maintain a balanced budget that accounts for both immediate needs and long-term financial security.

Creating a Flexible Budget

To create a flexible budget that adapts to changing financial situations, consider the following tips:

- Regularly review and adjust your budget based on income changes or unexpected expenses.

- Allocate a portion of your budget to a “miscellaneous” category for unplanned costs.

- Use budgeting tools and apps that allow for easy modifications and real-time tracking of expenses.

- Set realistic financial goals and adjust your budget to prioritize saving and investing for the future.

- Consider creating different budget scenarios to prepare for various financial outcomes.