With Behavioral biases in investing at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling american high school hip style filled with unexpected twists and insights.

When it comes to investing, understanding behavioral biases is like navigating the wild waters of high school drama – it’s crucial for success. Strap in as we explore the intriguing world where human psychology meets finance, revealing the hidden forces that influence our investment decisions.

Overview of Behavioral Biases in Investing

Behavioral biases in investing refer to the psychological tendencies or patterns that can influence an investor’s decision-making process, leading to irrational choices and potentially impacting investment outcomes. Understanding these biases is crucial for investors as it can help them recognize and mitigate the effects of these biases on their investment strategies.

Examples of Common Behavioral Biases

- Confirmation Bias: This bias occurs when investors seek out information that confirms their existing beliefs or opinions, while disregarding contradictory evidence. As a result, they may overlook important data that could challenge their investment thesis.

- Loss Aversion: Loss aversion is the tendency for investors to strongly prefer avoiding losses over acquiring gains of an equal magnitude. This bias can lead to suboptimal decision-making, such as holding onto losing investments for too long in the hopes of avoiding a loss.

- Herding Behavior: Herding behavior is when investors follow the actions of the crowd without conducting their own independent analysis. This can lead to market bubbles or crashes as investors act based on the actions of others rather than on sound investment principles.

- Overconfidence: Overconfidence bias causes investors to overestimate their knowledge, skills, or abilities, leading them to take on excessive risks or trade more frequently than necessary. This can result in poor investment performance and unnecessary losses.

Types of Behavioral Biases

When it comes to investing, behavioral biases can heavily influence decision-making and lead to suboptimal outcomes. Understanding these biases is crucial for investors to make more rational choices.

Confirmation Bias

Confirmation bias occurs when investors seek out information that confirms their existing beliefs while ignoring contradictory evidence. For example, an investor who believes a certain stock will perform well may only pay attention to news articles or analyst reports that support this view, disregarding any negative information. This bias can lead to holding onto losing investments for too long, hoping they will turn around.

Loss Aversion

Loss aversion is the tendency for investors to strongly prefer avoiding losses over acquiring gains of the same magnitude. This can result in a reluctance to sell losing investments, even when it may be the rational choice. For instance, an investor may hold onto a stock that is plummeting in value because they are afraid of realizing the loss. This bias can prevent investors from rebalancing their portfolios appropriately.

Herd Mentality

Herd mentality refers to the tendency for individuals to follow the actions of a larger group, often leading to irrational decision-making. In investing, this can manifest as investors buying or selling assets simply because others are doing the same, without conducting their own research or analysis. This can create market bubbles or crashes as prices become disconnected from fundamentals.

Impact of Behavioral Biases on Investment Strategies

Investing is not just about crunching numbers and analyzing financial reports. It also involves making decisions based on emotions, biases, and cognitive shortcuts that can sometimes lead to suboptimal outcomes. Behavioral biases can significantly impact investment strategies, influencing how investors make choices and manage their portfolios.

These biases can cause investors to deviate from rational decision-making, leading to decisions that are not based on sound financial principles. For example, the confirmation bias may lead an investor to only seek out information that supports their preconceived notions about a particular investment, ignoring contradictory evidence that could affect their decision.

Making decisions based on biased judgments can have serious consequences for investment performance. It can lead to missed opportunities, increased risk exposure, and subpar returns. Overconfidence bias, for instance, may cause investors to take on more risk than they can handle, leading to losses when the market turns against them.

Recognizing and mitigating these biases is crucial for improving investment performance. By being aware of our own biases and taking steps to counteract them, investors can make more rational and informed decisions. This can involve seeking diverse perspectives, conducting thorough research, and consulting with financial advisors to gain a more balanced view of potential investments.

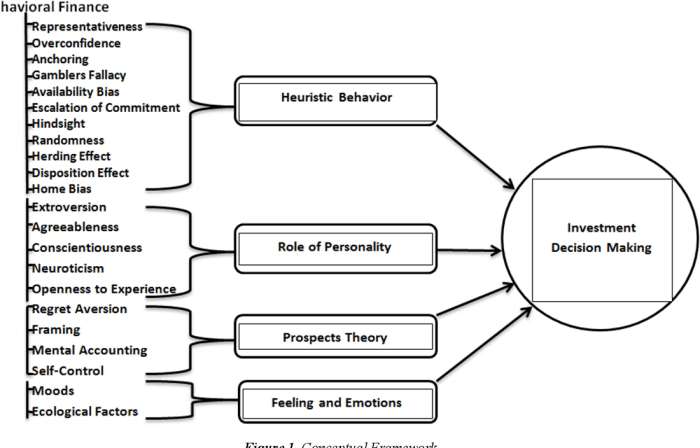

Behavioral Finance Theories

Investors are influenced by various behavioral finance theories that help explain their decision-making processes. These theories shed light on why investors may act irrationally when it comes to investing their money.

Loss Aversion Theory

Loss aversion theory suggests that investors feel the pain of losses more strongly than the pleasure of gains. This leads them to make irrational decisions, such as holding onto losing investments for too long or selling winning investments too soon. For example, an investor may refuse to sell a losing stock because they are too emotionally attached to the hope of breaking even, even though it may be more beneficial to cut their losses and move on.

Herding Theory

Herding theory explains how investors tend to follow the crowd rather than making independent decisions. This behavior can lead to market bubbles and crashes as investors act based on the actions of others rather than their own analysis. A real-world example of herding behavior is the dot-com bubble of the late 1990s when investors rushed to invest in internet companies without thoroughly evaluating their fundamentals, leading to a market crash.

Overconfidence Bias

Overconfidence bias suggests that investors tend to overestimate their abilities and knowledge when making investment decisions. This can lead to excessive trading, taking on too much risk, and underestimating the likelihood of losses. For instance, a trader may believe they have a unique skill in timing the market and consistently making profitable trades, leading them to take on more risk than they can handle.