Diving into the world of Annuities explained, get ready to unravel the mysteries behind this financial product that can shape your future. From understanding the basics to exploring the nuances, this guide will take you on a journey through the ins and outs of annuities.

As we delve deeper into the details, you’ll gain valuable insights into how annuities work, the various types available, and the pros and cons of incorporating them into your financial portfolio. So, sit back, relax, and let’s decode the world of annuities together.

What are Annuities?

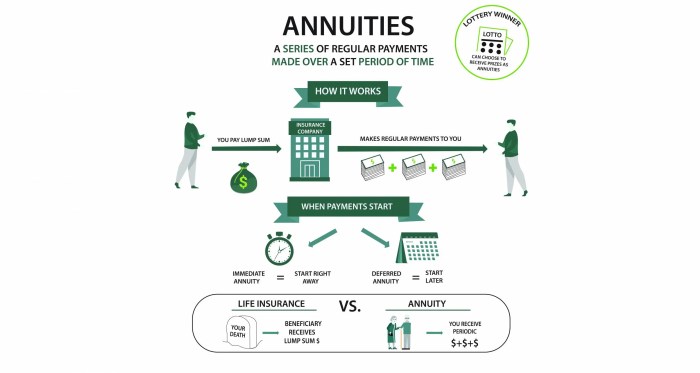

Annuities are financial products designed to provide a steady income stream for individuals during retirement. They are typically offered by insurance companies and can be a valuable tool for retirement planning.

Types of Annuities

Annuities come in various types, including:

- Fixed Annuities: These provide a guaranteed payout over a specified period, offering a stable income stream.

- Variable Annuities: These allow the holder to invest in different sub-accounts, with the payout depending on the performance of these investments.

- Indexed Annuities: These offer returns based on the performance of a specific index, such as the S&P 500, providing the potential for growth while protecting against market downturns.

Features and Benefits of Annuities

Annuities have several key features and benefits, including:

- Guaranteed Income: Annuities can provide a reliable income stream during retirement, ensuring financial security.

- Tax-deferred Growth: Earnings on annuities grow tax-deferred until withdrawal, allowing for potential compound growth over time.

- Death Benefit: In the event of the annuitant’s death, beneficiaries receive a death benefit, providing financial protection for loved ones.

- Flexibility: Some annuities offer options for customization, such as adding riders for long-term care or enhanced death benefits.

How do Annuities Work?

Annuities work as a financial product by providing a stream of income to an individual over a specific period. This can be beneficial for retirement planning or long-term financial goals. When you invest in an annuity, you are essentially entering into a contract with an insurance company.

Investing in an Annuity

- An individual makes an initial investment or a series of payments to the insurance company.

- The insurance company then invests the funds and agrees to make regular payments back to the individual at a later date.

- These payments can be immediate or deferred, depending on the type of annuity chosen.

Scenarios where Annuities can be Useful

- Retirement Planning: Annuities can provide a reliable source of income during retirement years when other sources may be limited.

- Long-Term Financial Goals: They can help individuals save and invest for the future, ensuring financial security down the line.

- Tax-Deferred Growth: Some annuities offer tax-deferred growth, allowing investments to grow without immediate tax implications.

Types of Annuities

When it comes to annuities, there are several types to choose from, each with its own unique features and benefits. Let’s dive into the differences between fixed, variable, and indexed annuities, as well as compare immediate and deferred annuities, and explore the annuitization phase.

Fixed Annuities

Fixed annuities offer a guaranteed interest rate for a specified period, providing a stable and predictable income stream. These annuities are a low-risk option suitable for individuals seeking steady returns without market exposure.

Variable Annuities

On the other hand, variable annuities allow investors to choose from a selection of investment options, such as mutual funds. The return on these annuities fluctuates based on the performance of the underlying investments, offering the potential for higher returns but also higher risk.

Indexed Annuities

Indexed annuities are tied to a stock market index, providing the opportunity to earn returns based on the index’s performance while also offering downside protection. These annuities combine elements of both fixed and variable products, making them a popular choice for risk-averse investors seeking growth potential.

Immediate Annuities

Immediate annuities start providing payouts shortly after the initial investment, offering a steady income stream for retirees or individuals in need of immediate cash flow. These annuities are ideal for those looking to convert a lump sum into guaranteed income right away.

Deferred Annuities

In contrast, deferred annuities allow investors to accumulate funds over time before starting to receive payments at a later date. This option is suitable for individuals planning for retirement or looking to supplement their income in the future.

Annuitization Phase

During the annuitization phase, the accumulated funds in the annuity are converted into a stream of income payments. This phase determines the amount and frequency of payouts, based on factors such as the annuitant’s age, life expectancy, and chosen payout options. It is a crucial step that impacts how long the income stream will last and the total amount received over time.

Pros and Cons of Annuities

Investing in annuities can offer several advantages for individuals looking to secure their financial future. However, like any financial product, annuities also come with certain drawbacks and limitations. It’s essential to understand both the pros and cons before deciding if annuities are the right choice for you.

Advantages of Annuities

- Guaranteed Income: Annuities provide a steady stream of income, which can be beneficial for retirees or anyone looking for a reliable source of funds.

- Tax-Deferred Growth: Earnings on annuities grow tax-deferred until withdrawal, allowing your investment to potentially grow faster compared to taxable accounts.

- Death Benefit: Some annuities offer a death benefit, ensuring that your beneficiaries receive a payout if you pass away before receiving the full value of the annuity.

- Customizable Options: Annuities come in various types that offer different features and benefits, allowing you to choose one that aligns with your financial goals.

Drawbacks of Annuities

- High Fees: Annuities can have high fees and expenses, which can eat into your returns over time.

- Complexity: Understanding the different types of annuities and their features can be challenging, leading to confusion and potential financial mistakes.

- Lack of Liquidity: Annuities are long-term investments, and early withdrawals may result in penalties or surrender charges.

- Inflation Risk: The fixed income provided by some annuities may not keep pace with inflation, leading to a decrease in purchasing power over time.

Suitability of Annuities

- Consider Annuities If: You are looking for a reliable income stream during retirement, want to supplement other sources of income, or seek tax-deferred growth.

- Avoid Annuities If: You prioritize liquidity, have a low risk tolerance, or prefer more straightforward investment options.

- Consult a Financial Advisor: Before investing in annuities, it’s crucial to consult with a financial advisor to determine if they align with your overall financial plan and goals.