When it comes to planning for retirement, the choice between 401(k) and IRA can be a major decision that impacts your financial future. Let’s dive into the details of these two popular retirement account options to help you make an informed choice.

Introduction

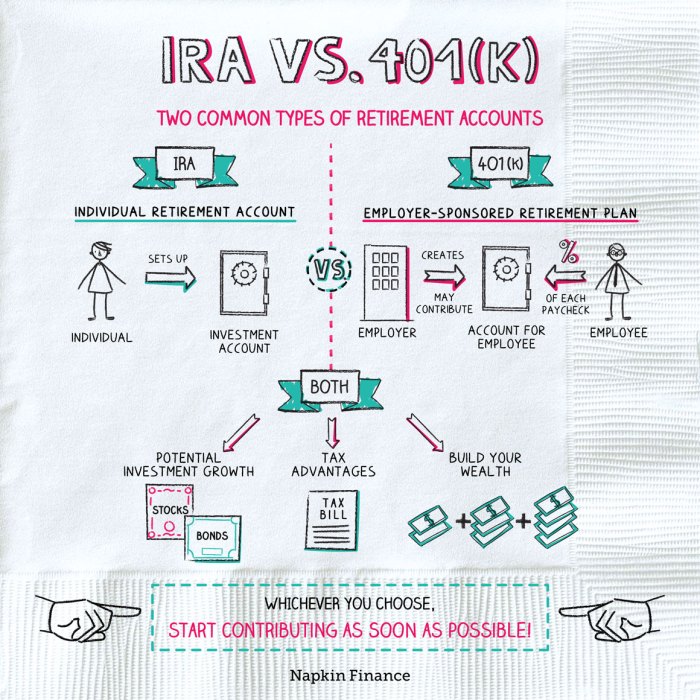

A 401(k) is a retirement savings account offered by employers, where employees can contribute a portion of their salary on a tax-deferred basis. On the other hand, an Individual Retirement Account (IRA) is a retirement account that individuals can open independently to save for retirement.

The purpose of retirement accounts like 401(k) and IRA is to help individuals save and invest for their retirement years. These accounts provide a way for people to set aside money during their working years so they can have financial security and independence in their retirement.

Importance of Saving for Retirement

It is crucial to start saving for retirement as early as possible to ensure a comfortable and secure future. Here are some key reasons why saving for retirement is important:

- Financial Security: Saving for retirement helps you build a nest egg that you can rely on when you stop working.

- Compound Growth: The earlier you start saving, the more time your money has to grow through compound interest.

- Independence: By saving for retirement, you can maintain your financial independence and not be reliant on others for support.

- Peace of Mind: Having a retirement savings plan in place can give you peace of mind knowing that you are prepared for the future.

401(k) Overview

401(k) is a retirement savings plan offered by employers to their employees. It allows individuals to contribute a portion of their pre-tax income into a specially designated account for retirement savings.

How a 401(k) works

A 401(k) works by deducting a percentage of your pre-tax income from each paycheck and depositing it into your 401(k) account. This money is then invested in a variety of options, such as stocks, bonds, and mutual funds, to help it grow over time.

Contribution limits and employer matches

There are annual contribution limits set by the IRS, which can change each year. In 2021, the limit is $19,500 for individuals under 50 years old and $26,000 for those 50 and older. Some employers also offer a matching contribution, where they match a percentage of your contributions up to a certain limit, essentially giving you free money for saving for retirement.

Types of 401(k) plans available

There are different types of 401(k) plans, including traditional 401(k)s, Roth 401(k)s, and Safe Harbor 401(k)s. Traditional 401(k)s allow you to contribute pre-tax dollars that are taxed when withdrawn in retirement, while Roth 401(k)s allow you to contribute after-tax dollars that grow tax-free. Safe Harbor 401(k)s have specific rules that make them more accessible to all employees and less likely to fail certain IRS testing requirements.

IRA Overview

When it comes to Individual Retirement Accounts (IRAs), they are a type of retirement savings account that individuals can open on their own. IRAs provide a way for people to save and invest for their retirement with certain tax advantages. There are different types of IRAs, but the two most common are Traditional IRA and Roth IRA.

Traditional IRA vs. Roth IRA

- Traditional IRA:

- Contributions are typically tax-deductible, meaning you can lower your taxable income for the year you contribute.

- Withdrawals in retirement are taxed as ordinary income.

- There are required minimum distributions (RMDs) starting at age 72.

- Roth IRA:

- Contributions are made with after-tax dollars, so they are not tax-deductible.

- Qualified withdrawals in retirement are tax-free.

- No required minimum distributions (RMDs) during the account owner’s lifetime.

Contribution Limits and Eligibility Criteria

- For the 2021 tax year, the contribution limit for both Traditional and Roth IRAs is $6,000 for individuals under age 50, and $7,000 for those age 50 and older (catch-up contribution).

- Eligibility to contribute to a Traditional IRA depends on income and whether you or your spouse have access to a retirement plan at work.

- Eligibility to contribute to a Roth IRA also depends on income, with higher earners facing contribution limits or restrictions.

Key Differences

When it comes to 401(k) and IRA, there are several key differences to consider. Let’s break it down for you.

Employer Sponsorship

In terms of employer sponsorship, 401(k) plans are typically sponsored by employers, meaning they set up the plan and may even match employee contributions up to a certain percentage. On the other hand, IRAs are individual retirement accounts that are not sponsored by employers. This means you are responsible for setting up and managing your IRA without any contributions from your employer.

Tax Advantages

When it comes to tax advantages, both 401(k) and IRA offer tax benefits, but they differ in how they work. 401(k) contributions are typically made with pre-tax dollars, meaning you don’t pay taxes on that money until you withdraw it in retirement. On the other hand, traditional IRA contributions are also made with pre-tax dollars, while Roth IRA contributions are made with after-tax dollars, allowing for tax-free withdrawals in retirement.

Investment Options

401(k) plans typically have a limited selection of investment options chosen by the employer, such as mutual funds and index funds. On the other hand, IRAs offer a wider range of investment options, including stocks, bonds, mutual funds, and more. This gives you more control over how you want to invest your retirement savings.

Withdrawal Rules

When it comes to withdrawing money from your retirement accounts, there are specific rules and penalties that you need to be aware of. Let’s dive into the differences between 401(k) and IRA withdrawal rules.

Penalties for Early Withdrawals from a 401(k)

Early withdrawals from a 401(k) refer to taking out money before you reach the age of 59 ½. If you withdraw funds early from your 401(k), you may be subject to a 10% penalty on top of regular income taxes. It’s important to note that there are certain exceptions to this penalty, such as for medical expenses or first-time home purchases.

Required Minimum Distributions (RMDs) for IRAs

Once you reach the age of 72, you are required to start taking withdrawals from your traditional IRA accounts. These mandatory withdrawals are known as Required Minimum Distributions (RMDs). The amount you must withdraw is calculated based on your life expectancy and account balance.

Withdrawal Flexibility Differences

One key difference between 401(k) and IRA accounts is the flexibility in withdrawals. With a 401(k), you may have limited investment options and withdrawal restrictions set by your employer. On the other hand, IRAs typically offer more flexibility in terms of investments and withdrawal timing, allowing you more control over your retirement savings.

Investment Choices

When it comes to investment choices, both 401(k) and IRA offer different options for individuals to grow their retirement savings.

401(k) Investment Options

In a 401(k) account, investment options are typically limited to a selection of mutual funds, ETFs, and sometimes company stock. These options are chosen by the employer or plan administrator, giving employees a range of pre-selected investments to choose from.

IRA Flexibility

On the other hand, an IRA offers much more flexibility in terms of investment choices. Individuals can invest in a wide variety of assets including stocks, bonds, mutual funds, ETFs, real estate, and even alternative investments like precious metals. This flexibility allows individuals to tailor their investments to their risk tolerance and financial goals.

Control Over Investments

In a 401(k) account, individuals have limited control over their investments as the options are pre-determined by the employer. However, in an IRA, individuals have full control over their investment choices, allowing them to actively manage their portfolio and make changes based on market conditions or personal preferences.

Portability and Flexibility

When considering retirement savings options, it’s crucial to understand the portability and flexibility of 401(k) accounts and IRAs. Let’s dive into how these factors play a role in your decision-making process.

Portability of 401(k) Accounts

401(k) accounts offer a high level of portability when changing jobs. When you leave your current employer, you have several options for your 401(k) account. You can choose to leave it with your former employer, roll it over into your new employer’s 401(k) plan, roll it over into an IRA, or cash out the account (though this option may result in penalties and taxes). This flexibility allows you to maintain your retirement savings and continue building upon it, regardless of job changes.

Transferability of IRAs

IRAs also provide a great deal of transferability between financial institutions. If you’re unhappy with your current IRA provider or find a better option elsewhere, you can easily transfer your IRA to a different financial institution without incurring taxes or penalties. This flexibility allows you to take advantage of better investment options, lower fees, or improved customer service without disrupting your retirement savings strategy.

Flexibility of Contributions and Withdrawals

When it comes to contributions, 401(k) plans typically have higher contribution limits compared to IRAs. In 2021, the annual contribution limit for 401(k) plans is $19,500 (or $26,000 for those aged 50 and older), while IRAs have a limit of $6,000 (or $7,000 for those aged 50 and older). This higher limit in 401(k) plans allows you to save more for retirement each year.

In terms of withdrawals, 401(k) plans generally have stricter withdrawal rules compared to IRAs. With a 401(k) plan, you may face penalties for early withdrawals (before age 59 ½) and required minimum distributions (RMDs) starting at age 72. On the other hand, IRAs offer more flexibility in terms of withdrawals, allowing penalty-free withdrawals for certain expenses like first-time home purchases or qualified education expenses.